Risk Strategies

-

The business is beginning to integrate following a $9.8bn acquisition.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Risk Strategies parent company had also been the subject of bids from Marsh and Howden.

-

The $10bn acquisition of Risk Strategies is the biggest broker deal relative to size we have seen.

-

The acquirer will carry out a ~$4bn equity placement to help finance the transaction.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Sources said that negotiations are proceeding well with a path to do a cash deal.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

-

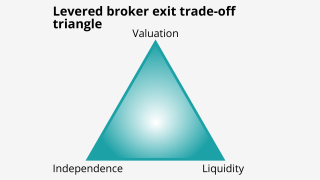

Insurance Insider US examines potential tariffs’ impact on the PE-backed brokers amid the jammed conveyor belt.

-

Sources said Brown & Brown has an advantage as it entered the process several weeks ago.