-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Sills’ background, a strong backing, and laser-sharp E&S focus make Bowhead stand out.

-

The executive was named group CEO in January.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

Since leaving Hiscox Krefta has founded a consultancy.

-

AIG veteran Kevin Bidney will focus on North American marine.

-

A quick roundup of today’s need-to-know news, including AIG, McKechnie’s Vivere, State Farm and more.

-

Coverage will increase to $20mn per building.

-

Joe Fobert will report to William Hazelton, EVP of Everest.

-

The executive said AIG’s E&S arm can grow 20% a year and generate $4bn of new business.

-

The start-up is closing a Series A fundraise.

-

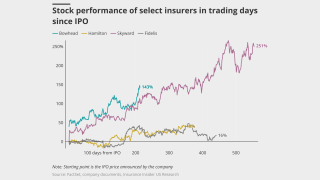

There is a long waiting list of carriers looking to pull the IPO trigger, but market conditions remain tough.