-

Sources said the Evercore-run Risk Strategies process has drawn the interest of Brown & Brown.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

Jeanmarie Giordano joined the company last September.

-

A quick roundup of our best journalism for the week.

-

The company’s stock jumped 14% within 30 minutes of the market’s open.

-

Defendants claim that Tradesman lacks standing to bring the case.

-

The judge noted similarities in Dellwood’s business plan and AIG’s.

-

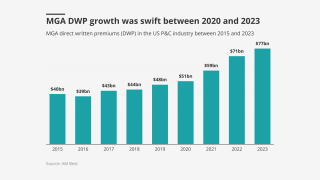

After a period of business building, MGAs will likely spend more time optimizing.

-

The shares will be purchased via the open market or private third-party transactions.

-

A quick roundup of today’s need-to-know news, including RSUM targeting a sidecar and Georgia's legal reform bill.

-

Both bills are now on Governor Kemp’s desk awaiting signatures.