INDUSTRY EVENTS

Target Markets Summit 2024

Get exclusive news and insights from the ground at the Target Markets in Scottsdale, AZ on October 21-23

INDUSTRY EVENTS

Target Markets Summit 2024

Get exclusive news and insights from the ground at the Target Markets in Scottsdale, AZ on October 21-23

Latest News

Latest News

Corvus CEO Tadikonda to depart Travelers for other opportunities

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

Ellers abruptly replaces DeWolf as QEO CEO

The change was made on December 2 and was effective immediately.

Acrisure to acquire MGA Vave from Canopius

Canopius will continue to be one of several capacity providers to the MGA.

-

Insurance Insider US reviews Euclid’s process and recent events in US MGA and retail broking.

-

The executive will report to Katalyx president and CEO Praveen Reddy.

-

The executives are based in Seattle and New York.

-

The London-based MGA will begin underwriting its international book next month.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

The valuation for the Jay Rittberg-led program manager is understood to be $1bn+.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

The company announced four key leadership appointments on Wednesday.

-

The capacity deal comes over a year after Dual recruited Marilena Rodriguez Forero as CEO for the region.

-

Existing facilities and carrier partners will be transferring from K2.

-

The MGA began offering US commercial E&S property products in December.

-

Longbrook Insurance will write multiple lines of business.

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

Adeptive co-founder and CUO Jeff Bright will lead the MGU’s US strategy.

-

HNW family offices are now among investors considering the US MGA segment.

-

It is understood that Sutton National is the fronting carrier sitting behind the facility.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The company is looking to grow through its new MGA incubator program.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

MGAs that are good operators will stick out compared to the rest.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

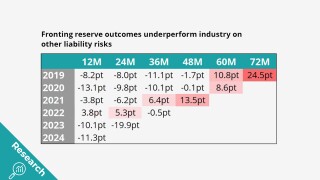

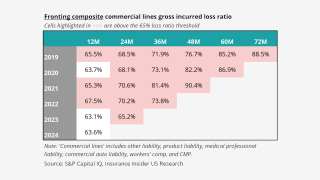

Fronting doesn’t look any better when it’s broken down by segment.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The MGA platform wants to expand into Europe and the UK and grow its wholesale business.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

The company will continue its capacity partnership with the MGA until 2030.

-

JH Blades, Southern Marine and Energy Technical Underwriters will merge to form the new brand.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The WCB has denied the allegations, claiming its decisions were based on “reasonable investigations”.

-

The company is estimating its IPO price at $18-$20 per share.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

Onex is making the investment alongside PSP, Ardian and others.

-

The case is now headed to appellate court.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

The program, expected to start doing business next month, will be wholesale-only.

-

This publication reported earlier today of the asset manager’s foray into the MGA space.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

The business said it was experiencing strong momentum on the Island.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Altamont Capital MD Sam Gaynor said the goal is to have fewer programs that can each grow to a significant size.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

The company generated $71.4mn in revenue for H1 2025.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

The PE-backed MGA has Morgan Stanley, Bank of America and JPMorgan advising.

-

Arkansas-based RVU provides commercial P&C and some specialty programs.

-

A view into PE-fueled activity in the MGA sector, as LatAm carrier M&A accelerates.

-

Lisa Binnie will succeed him as president of the company’s specialty admitted segment effective September 1.

-

The likes of Genstar, Leonard Green and Bain also looked at the program manager.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

Sources said that the start-up will be fronted by Bain-backed Emerald Bay.

-

The executive succeeds current CEO Petway, who is retiring.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

The executive has worked for JLT Re, Lockton Re, Willis Re and US Re.

Videos from Target Markets 2024

Videos from Target Markets 2024

-

Target Markets is hoping to expand to offer scholarships to additional students next year, says Gene Abby, executive director, Target Markets

-

In Partnership With Alimco Re Ltd.Chris Dougherty, CEO of Alimco Re, shares insights on the firm’s strategy and market goals at Target Markets.

-

Greg Massey, US Adviser for VIPR, shares insights on growth, challenges and data’s role in sustaining profitable program insurance portfolios.

-

Bob Hartwig, Professor of Insurance with the University of South Carolina, discusses the resilient US economy, election impacts and future growth in specialized insurance sectors at the Target Markets conference in Scottsdale, Arizona.

-

In Partnership With Origin SpecialtyJerico Vinsonhaler, VP & Head of Workers Comp for Origin Specialty Underwriters discusses a soft workers' comp market amid rising coverage challenges, at Tarket Markets 2024.

-

In Partnership With DualConnie Germano discusses social inflation, collaboration, and limits in the evolving excess casualty market.

-

In Partnership With ArchPaul Sullivan shares updates on Arch's growth strategy and the evolving delegated authority market, at the Target Markets 2024 Conference.

Thank you to our sponsors