-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The investor offloaded nearly 100,000 Allstate shares in Q3, according to its latest 13-F.

-

The $21/share pricing falls in the middle of the expected range.

-

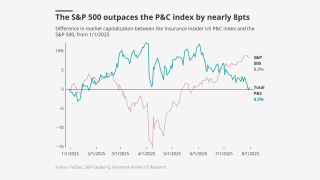

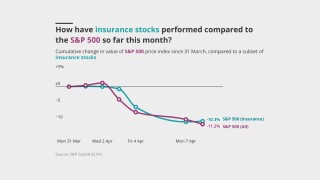

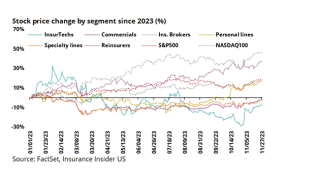

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

MultiStrat, the founder of casualty ILS, is focusing on committed capital to grow, said Bob Forness, CEO, MultiStrat.

-

The selloff may hint at headwinds for equity investors.

-

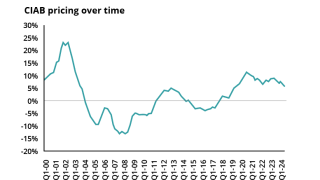

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

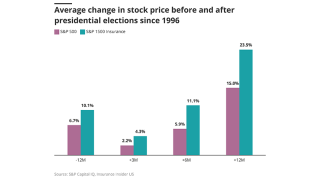

Industry stocks were firmly behind the S&P 500 in Q3.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

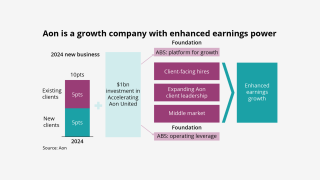

The president expects to see benefits from the deal in H2 2026.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The broker posted a 6.5% drop in organic growth YoY.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

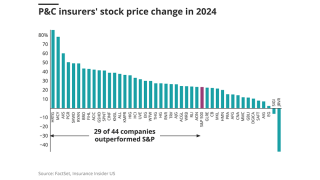

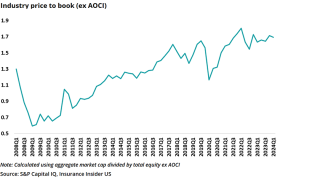

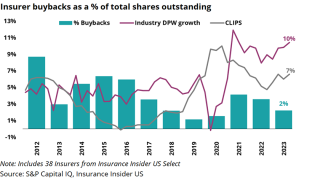

P&C’s outperformance lead dwindles, while specialty rises above other segments.

-

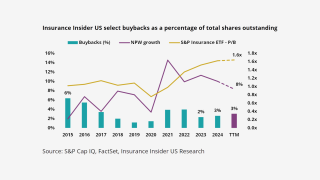

Additional buybacks are more feasible if P&C stocks slip and pricing moderates.

-

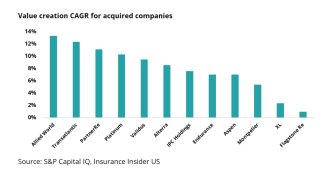

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

Insurance outperformance slows as markets recover from tariff shock.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

The bond will provide named storm and quake coverage in the US.

-

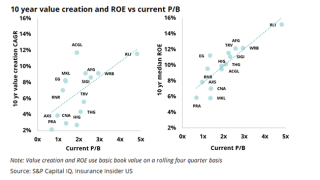

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

The program will succeed the previous buyback launched in 2023.

-

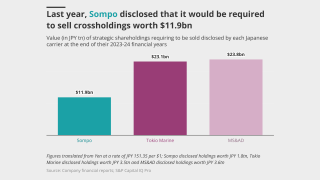

The conglomerate’s insurance subsidiaries will have to make do without some of their prior strategic advantages.

-

P&C held up better than the S&P 500, but there are causes for longer term concern.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Inflection sets in for insurance stocks as macro albatross gets heavier.

-

Macroeconomic volatility could also create top-line headwinds.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

The program will provide excess casualty coverage across a broad range of industries.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Insurance’s demand inelasticity will be its greatest strength in 2025.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Insurance share prices were resilient amid today’s market meltdown.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

The company’s stock jumped 14% within 30 minutes of the market’s open.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

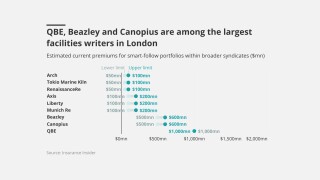

Industry sources estimate the market to be around $3bn.

-

The insurance market remains generally immune to tariff uncertainty, but not all is well.

-

The big brokers are lining up London capacity to write follow lines on US risks.

-

On Monday, the firm reported a Q4 CoR of 155.1%, versus 98.1% a year ago.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

Insurance stocks are lukewarm amid earnings season, cats and political changes.

-

The board will lead the review following feedback from shareholders including activist investor Jana.

-

The PE firm held over 6.7 million Axis shares, around 8.2% of shares outstanding.

-

The carrier’s Q4 operating EPS declined to $0.41 from $0.77 in Q4 2023.

-

Most insurers outperformed the S&P 500 last year, but the trend is unlikely to continue.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

In June 2023, Hale Partnership got its license from the Cayman Islands Monetary Authority for HP Re.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

The firm had owned 3.45 million shares in Q2, then valued at over $256mn.

-

Multiple reinsurance brokers have pitched the firm for sidecars.

-

Republican tariffs and higher Democratic corporate taxes would hurt the sector.

-

The stock was hovering around $40 per share just before closing.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

The Floridian insurer anticipates that it will remain profitable in Q3 and Q4 despite hurricane activity.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

Milton’s significant but less-than-expected hit shifts our expectations for industry recovery.

-

Shares gained after Hurricane Milton did less damage than anticipated.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

The move comes less than a year after AssuredPartners’ sale process reached a stalemate.

-

While Republicans are typically perceived as best for business, there are several factors at play.

-

The move comes just days after the Warren Buffett-controlled conglomerate reached the $1tn market cap mark for the first time.

-

Westaim reported roughly $79mn in net proceeds from the sale.

-

Reagan Consulting has been retained to advise the ~$125mn Utah-based brokerage.

-

The conglomerate now owns around 27 million Chubb shares valued at roughly $6.9bn, compared to nearly 26 million in Q1.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

S&P’s Insurance Select industry index had fallen by 2.7% at market close.

-

The funds were contributed to support the specialty carrier’s growth.

-

BHMS joins a group of Boost backers that includes Markel, Canopius US and management.

-

With the deal, 1970 secured capital to boost its liquidity management services for insured companies.

-

The Hartford and Aon also posted notable, though more muted, stock bumps.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

The news follows a string of deals that the stop-loss segment has seen in recent months.

-

The carrier’s CoR increased 15.9 points YoY to 116.1% on unfavorable GL development.

-

Longstanding investor Stone Point will continue as a partner and board member.

-

It is understood that the company expects to launch its Florida reciprocal in Q4.

-

Stable first half insufficient to counterbalance concerns on reserving trends.

-

Sources said the deal between the PE firms valued the broker at in excess of 16x Ebitda, or $4bn+.

-

It is understood that the goal is to use a capital injection to form a reciprocal.

-

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

Insurance Insider US recently revealed the parties were in advanced sale talks.

-

The executive gave his view on the (re)insurance landscape and the impact of PE on the sector.

-

In January, this publication revealed that the Southern retailer retained Piper Sandler to run an auction to bring in a new PE investor.

-

Onex has proposed an alternative sale structure, which includes R&Q’s potential liquidation.

-

Analysis of company performance post-IPO shows varying trajectories over time

-

The company increased its full year 2024 adjusted net income guidance.

-

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The proposals include increasing either statutory or CRTF funds.

-

The start-up's founder set out the new broker’s strategy, M&A goals and structure.

-

PE house Vistria will back the buy-and-build strategy in the independent agency space.

-

The $6.7bn Chubb investment is an outlier in the Berkshire portfolio.

-

Citizens also secured $1.1bn of limit for its Everglades Re cat bond.

-

The conglomerate exited its $620mn position in Markel, which it has held since 2022.

-

An overview of Q1 earnings shows upsides, but also plenty of concerns going into the rest of 2024.

-

New leaders of these reinsurers have started strong, but Axis still has work to do.

-

The broker’s opening price on Friday was $272.10 per share, versus Thursday’s closing price of $306.

-

Earlier today, the carrier reported that its Q1 combined ratio came in at 88.8%, down from last Q1’s 90.6%.

-

Sources said Piper Sandler will run the auction for the CIVC-backed firm.

-

P&C buybacks have continued to decline, but large authorizations keep companies flexible.

-

It is understood that the company aims to launch in Q3 or Q4 of this year.

-

Sources said the process will target buyout firms and will not be open to trade bidders.

-

Hiscox, Intact Ventures, Weatherford and RPM Ventures participated in the fundraise.

-

Shares had fallen over 20% since Monday.

-

James River is suing Flemming Intermediate while a potential sale of the company is ongoing.

-

This publication revealed that the company was raising capital earlier this year.

-

The InsurTech’s shares gained over 50% in value on Thursday.

-

SEC filings show that Travelers’ equity ownership was valued at over $107mn in Q4.

-

The company would ideally like to target a minority investment.

-

Enstar acquired 637,640 shares of James River in Q4 last year valued at nearly $6mn.

-

The company provides a platform for brokers to value, buy and sell books of business.

-

The company will hold its Q4 earnings call on Friday February 16.

-

The company's reinsurance panel has expanded to over a dozen risk capital providers.

-

Intact Ventures, Era Ventures, Greenlight Re and Spark Capital also participated.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

Last year, this publication revealed that TPA SCM and Rimkus launched sales processes.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

It is understood that the InsurTech began fundraising late last year.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

On Wednesday, the insurer reported 12% growth in net written premiums.

-

Sources said that the retailer will be marketed off an Ebitda of $40mn-$45mn, pointing to a potential valuation in the $650mn-$750mn range.

-

Participating in the funding round were Caffeinated Capital, Altai Ventures, Zigg Capital, 8VC, Buckley Ventures, Habitat Partners and Arch Capital.

-

The Aspen IPO provides an opportunity to benefit from the specialty market without commensurate prior-year reserve risks due to an LPT cover.

-

The agency said TRUE’s ratings will remain under review until there is additional clarity surrounding a new business plan.

-

TRUE will use the capital injection to provide underwriting capacity in Florida “at a crucial time” and to expand its footprint nationally, according to a statement.

-

A more consistent trading rhythm returned to the property market, with capacity deployment outside of frequency-exposed layers and more heavily loss-impacted segments bouncing back.

-

Insurance Insider US dissects the largest and hottest deals of the year across broking, reinsurance and other segments of the industry.

-

The deal’s consideration consisted of a cash payment of $119mn and the 13.5% equity interest that Enstar held in Northshore, the parent of Lloyd’s underwriter Atrium.

-

Leading the decline was AJ Gallagher, with a 7.5% drop as of mid-afternoon, after having traded down over 8% earlier in the day.

-

Earlier this morning, SiriusPoint announced it had been informed that major shareholder CMIH had been taken into private receivership by lenders in Singapore.

-

The suspension of Global Indemnity’s effort to sell its E&S arm is likely specific to the franchise rather than an indicator of a dealmaking slowdown.

-

Sources said the Gemspring Capital-backed group retained investment bank Baird earlier this year as adviser in the sale process.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

A quick roundup of this week’s biggest stories.

-

The latest short interest data shows continued pessimism on InsurTechs and Florida insurers.

-

The fundraise was led by Golub Capital and jointly arranged by Antares Capital, both existing lenders to Patriot Growth.

-

This latest funding round brings total committed capital for the collateralized reinsurer to $75mn.

-

In addition to Lightyear’s capital injection, current backer BHMS agreed to roll a material portion of its existing equity and made an additional investment alongside Lightyear.

-

The offering sold 3.6mn shares priced at $30.50 apiece and brought in approximately $104.9mn.

-

Amynta Ease-of-Business president Arthur Seifert said he expects MGAs to move away from the popular Dutch auction process and instead find one party that’s a good fit.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.