-

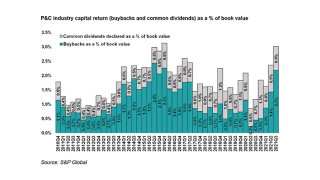

The higher level of repurchases seen in Q3 will likely last longer than expected.

-

The classic car underwriter will use the proceeds from its most recent fundraise to spur organic growth, and invest in data, technology, and geographic expansion.

-

In November, the Inside P&C Select was -6.8%, underperforming the S&P 500 which delivered -0.8%.

-

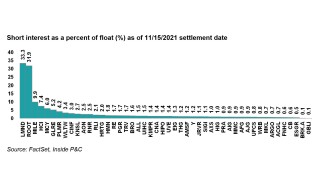

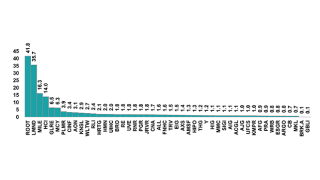

Short interest fell in InsurTechs, but not enough to ease the pressure on the sector.

-

Insurance carriers tend to favor a negative outlook during their earnings calls, even when its unwarranted.

-

Root shares leap in Thursday trading after InsurTech posts revenue gain, per-share loss that best Wall Street expectations.

-

InsurTech stock price dips fail to shake short interest from the firms.

-

InsurTech shares trade mixed in response to Lemonade-Metromile combination.

-

Root and Lemonade remain the highest-shorted stocks covered, as short interest in most firms remains flat in anticipation of earnings.

-

James River stock tumbles, Brown & Brown slips, RenRe sees modest gains on Q3 results.

-

Margin expansion and higher returns to shareholders would come at a cost with a cut in investment and staff over the coming years.

-

Short interest attention remains concentrated on InsurTech stocks as the industry awaits the update in earnings next week.