-

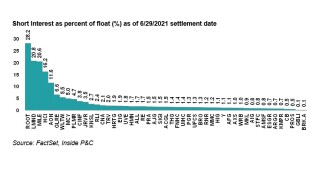

Changes in short interest were muted despite large stock moves, including big rises at HCI and Lemonade.

-

The InsurTech is said to be in negotiations with blank check company PWP for a merger.

-

With the exception of InsurTechs, short interest movement was muted in the absence of material catalysts.

-

CEO Juan Andrade laid out the new targets in an investor day presentation in which he said the carrier will become a “digital first” (re)insurer.

-

Every market is going to have to decide where they stand on the issue of SPACs, said AIG’s head of North America financial lines.

-

Short interest data shows an incremental uptick in short interest for InsurTechs, with slight declines for the brokers.

-

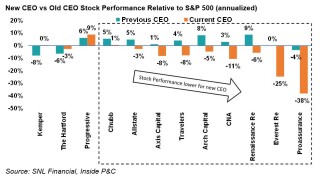

New CEOs were not able to consistently create higher book value growth than their predecessors, and any growth achieved wasn’t maintained after five years.

-

P&C stock movement in May centered on pricing commentary and economic recovery, with little impact from the forecast above-average hurricane season.

-

The executive had previously been the head of third-party capital at Axis.

-

The SPACs merging with Hippo, Doma and Qomplx are all trading below the redemption price.

-

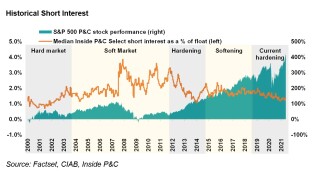

Management should examine the relationship between company strategy, broader market cycles and short interest.

-

Reinsurance recoveries and subrogation payouts helped to minimize retained cat losses to $466mn, post-tax.