-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The investor offloaded nearly 100,000 Allstate shares in Q3, according to its latest 13-F.

-

The $21/share pricing falls in the middle of the expected range.

-

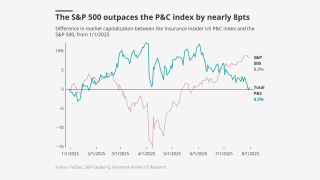

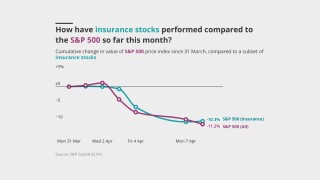

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

MultiStrat, the founder of casualty ILS, is focusing on committed capital to grow, said Bob Forness, CEO, MultiStrat.

-

The selloff may hint at headwinds for equity investors.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

Industry stocks were firmly behind the S&P 500 in Q3.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

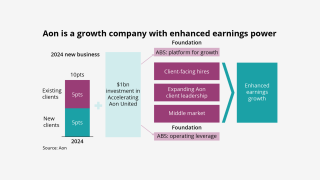

The president expects to see benefits from the deal in H2 2026.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The broker posted a 6.5% drop in organic growth YoY.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

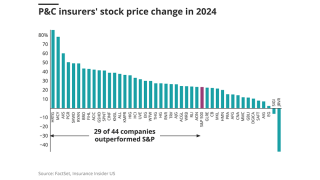

P&C’s outperformance lead dwindles, while specialty rises above other segments.

-

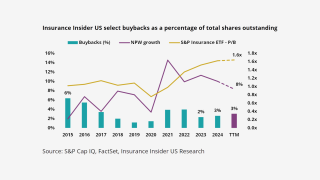

Additional buybacks are more feasible if P&C stocks slip and pricing moderates.

-

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

Insurance outperformance slows as markets recover from tariff shock.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

The bond will provide named storm and quake coverage in the US.

-

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

The program will succeed the previous buyback launched in 2023.

-

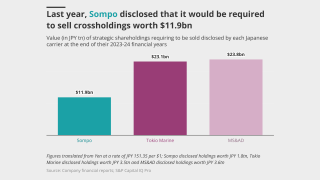

The conglomerate’s insurance subsidiaries will have to make do without some of their prior strategic advantages.

-

P&C held up better than the S&P 500, but there are causes for longer term concern.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Inflection sets in for insurance stocks as macro albatross gets heavier.

-

Macroeconomic volatility could also create top-line headwinds.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

The program will provide excess casualty coverage across a broad range of industries.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Insurance’s demand inelasticity will be its greatest strength in 2025.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Insurance share prices were resilient amid today’s market meltdown.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

The company’s stock jumped 14% within 30 minutes of the market’s open.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

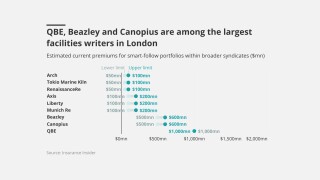

Industry sources estimate the market to be around $3bn.

-

The insurance market remains generally immune to tariff uncertainty, but not all is well.

-

The big brokers are lining up London capacity to write follow lines on US risks.

-

On Monday, the firm reported a Q4 CoR of 155.1%, versus 98.1% a year ago.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

Insurance stocks are lukewarm amid earnings season, cats and political changes.

-

The board will lead the review following feedback from shareholders including activist investor Jana.

-

The PE firm held over 6.7 million Axis shares, around 8.2% of shares outstanding.

-

The carrier’s Q4 operating EPS declined to $0.41 from $0.77 in Q4 2023.

-

Most insurers outperformed the S&P 500 last year, but the trend is unlikely to continue.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

In June 2023, Hale Partnership got its license from the Cayman Islands Monetary Authority for HP Re.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

The firm had owned 3.45 million shares in Q2, then valued at over $256mn.

-

Multiple reinsurance brokers have pitched the firm for sidecars.

-

Republican tariffs and higher Democratic corporate taxes would hurt the sector.

-

The stock was hovering around $40 per share just before closing.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

The Floridian insurer anticipates that it will remain profitable in Q3 and Q4 despite hurricane activity.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

Milton’s significant but less-than-expected hit shifts our expectations for industry recovery.

-

Shares gained after Hurricane Milton did less damage than anticipated.