-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

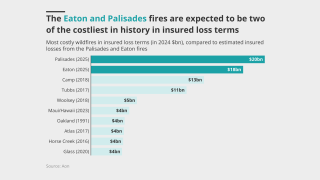

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

The highest portion of losses was experienced in Alberta.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

The peril has been historically difficult to model compared to others.

-

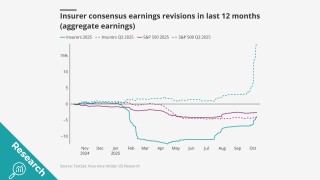

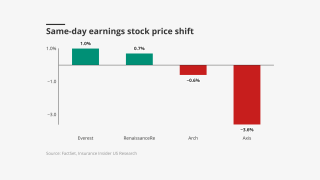

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

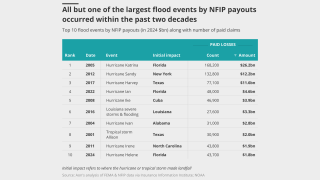

The deal to reopen the government also extended the NFIP.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The credit can now be applied to mitigation against operational losses.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Widespread underinsurance and low exposures will limit losses.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

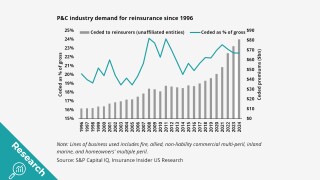

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

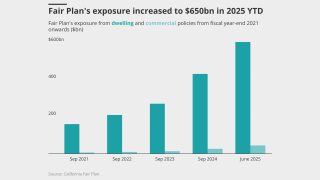

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

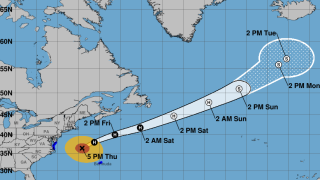

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

A former NOAA climatologist who left the agency is running the new operation.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Critics claim the dispute system denies consumers' key legal rights.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

The governor has yet to sign a pending bill to create a public cat model.

-

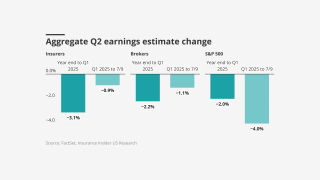

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The tropical cyclone is expected to be named Imelda.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

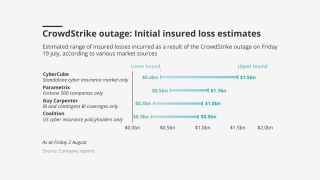

The risk also ranked as a top three concern for companies of all sizes.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

The fundraising round brought in $50mn for the insurer.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

The data modeling firm said losses previously averaged $132bn annually.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The group claims the White House is undermining disaster preparedness.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

The estimate covers property and vehicle claims.

-

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

Both organisations still predict an above-average hurricane season.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

The forecast has increased since the early July update due to several additional factors.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The risk of cyber incidents that cause physical damage is also rising.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

The CEO said business remains adequately priced in most classes.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The company adjusts its rate options to expand California business under the new cat model.

-

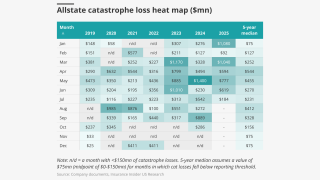

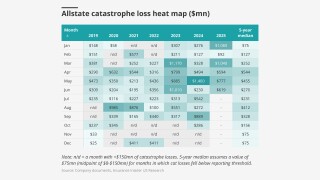

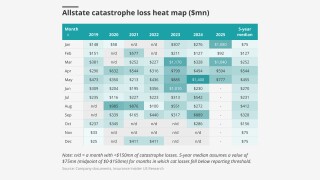

The research team presents the June cat heatmap.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

Rate gains are easing across many commercial and personal lines.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

State legislation has led to major strides in rate adequacy.

-

Social inflation, reserving, and organic growth are the topics to watch this earnings season.

-

Category 4 and 5 storms could become more common and hit further north.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

The floods have killed at least 81 people, with dozens more missing.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The company said the reduction was due to years of steady improvements.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

Much was learned after the fires, but it could take years before that data influences models.

-

The research team presents the May cat heatmap.

-

It didn’t have a major impact on insurers’ finances – instead, it served as a wake-up call.

-

The regulatory body is also looking at AI rulemaking and catastrophe resiliency.

-

Allstate attributed the bulk of its losses to three major wind and hail events.