-

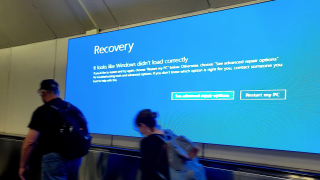

The broker said less than 1% of companies globally with cyber insurance were impacted.

-

Securities class actions are a perennial source of claims for D&O insurers.

-

Over 75% of insured losses attributable to severe thunderstorms, flooding and forest fires.

-

The firm said losses could fall under $300mn if more favourable assumptions were applied.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

The event would represent a loss ratio impact of roughly 3%-10% on global cyber premiums of $15bn today.

-

The weighted average direct financial loss for a Fortune 500 firm was $44mn.

-

Underwriters are getting increasingly granular, rewarding mitigation and prevention with better terms.

-

The carrier’s cyber hours clauses and sub-limits will limit exposure, according to the analyst.

-

Market sources suggest that this will be a manageable loss, although at this early stage there are multiple uncertainties.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

Insured losses in the single-digit billions would not translate into a material impact for (re)insurers.