-

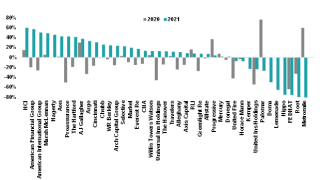

Consolidated Ebitdac margins expanded by 210bps, helped by 420bps of margin expansion in national programs and 120bps of improvement in retail brokerage.

-

The intermediary reports that 2021 premiums jumped 45%, pushing its full-year organic growth up 30%.

-

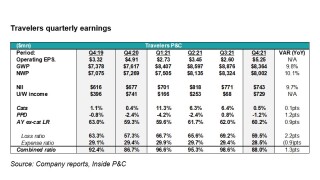

The firm reported encouraging quarterly earnings, but social inflation and other challenges still loom.

-

The insurer increased its occurrence treaty coverage by $300mn as the aggregate deal shrank, following a full loss to reinsurers in 2021.

-

Truist’s chief insurance officer John Howard said favorable market conditions position the unit for an even better year in 2022.

-

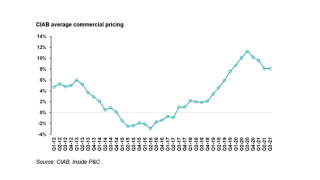

With Q4 cat losses relatively benign, the focus in Q4 2021 will be on underlying dynamics including the impact of rate rises, Omicron and the economy.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Premium renewal rate on the carrier held at 99%, increasing the year-to-date rate to 96% through 30 November.

-

The Iowa-based carrier reached this milestone for the first time in its history in July.

-

The carrier’s underlying loss ratio, excluding the effects of catastrophes and prior-year developments, improved to 63% in Q3 from 68.8% the previous year.

-

Insurance carriers tend to favor a negative outlook during their earnings calls, even when its unwarranted.