-

The CEO said his company would be going on offense to accelerate book value growth while strong market conditions lasted.

-

Earnings at the international non-life business also halve as EMEA operations swing to a 12.5bn yen loss.

-

The company shrank its gross premium writings in the quarter by 12% to $138mn.

-

Will the latest iteration of re-underwriting and management change improve the return profile of one of the largest (re)insurance franchises?

-

The company was weighed down by a spike in mortgage claims, and higher cat losses in both insurance and reinsurance.

-

The company also said that it expects to grow underlying margins through underwriting actions that go beyond price improvement.

-

Pure pricing data suggested the D&O market kept taking rate-on-rate in Q4, while the policy restructuring and retention data showed early signs of peaking.

-

The (re)insurer had previously disclosed the $400mn reserve charge, largely connected to casualty reinsurance business from accident years 2015 to 2018.

-

The company improves its underlying loss ratio but takes a $19mn reserve charge in its commercial segment.

-

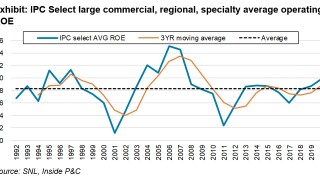

The second week’s reporters continued to build upon the theme of rate momentum likely translating into ROE expansion.

-

-

Executives reiterate the mid-single expansion guidance announced in March, despite growing organically by 1% in 2020.