-

Doyle’s comments follow bullish commentary from underwriting executives and a Travelers disclosure last week that the pace of gains had slowed.

-

Marsh grew its underlying top line by 4%, while Guy Carpenter gained by 5%.

-

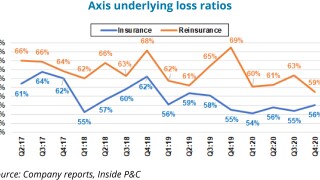

The focus is on progress on underlying loss ratio gains, managing cat exposures and curbing expenses.

-

Growth remains an important topic for Berkley given that since Q1:20 rate increases have outpaced its GWP growth.

-

The additional $730mn in capital for its Upsilon RFO, DaVinci and Medici funds include $130mn of the company’s own money.

-

Despite the strong organic growth of 4.7%, the results beneath the surface suggest that pandemic challenges remain.

-

Overall net income was up by 21% on the year, to $481mn, as top line revenue increased by 9.2%, or $221mn, to $2.61bn.

-

The broker’s 5% organic growth was flattish versus Q3 but management’s tone pointed to more bullishness on the operating environment and the economy.

-

Travelers’ 54% beat came with a collection of good news, including rate increases, margin expansion and positive reserve development.

-

Standard carriers are pushing risk to the wholesale market, said banking and insurance head Henson.

-

Net profits grew 67% over the quarter to $99mn, as brokerage unit expanded margins by 390 bps.

-

Underwriting income nearly doubled on underlying gains, lower cats, higher rates and stronger reserve releases.