-

The Floridian also anticipates $115mn to $125mn in net income for the quarter.

-

A favorable nine months for the industry does not solve its underlying problems.

-

Loss ratios in troubled casualty lines ticked down year-over-year despite worsening loss costs.

-

Kemper and Selective’s woes stem partly from own issues, but industry-level issues persist.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The company expects to have $415mn to $430mn of third-party written premium in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

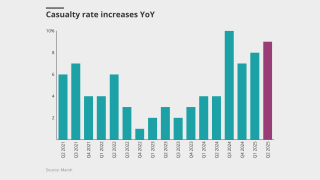

The company has now posted rate increases for 37 consecutive quarters.

-

The company is also prepared for potential M&A activity.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

Underwriting income for North America quadrupled to $384mn, and the segment recorded a CoR of 82.6%.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Dairy and livestock products within the agricultural unit were main growth drivers in Q3.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The CEO said the carrier is seeing sequential PIF growth in several states.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

Opportunities for growth remain in small and medium commercial accounts.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The specialty carrier’s share price fell nearly 7% on the day of the call.

-

The company sees itself in a “very strong position” in the state.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company saw growth accelerate in its property and casualty segments.

-

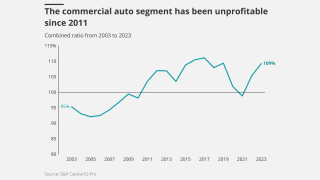

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Pre-tax cat losses were down 63% from the prior year quarter to $285mn.

-

A quiet wind season is also expected to further soften the property market.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

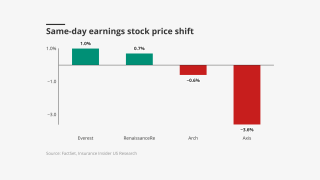

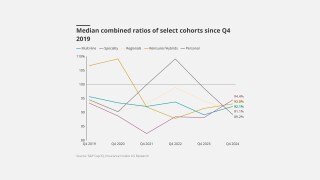

Early Q3 earnings reports point to worsening market conditions.

-

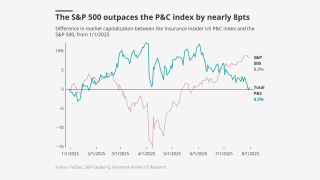

The selloff may hint at headwinds for equity investors.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

The carrier reported favorable reserve development of $22mn compared to $126mn in Q3 last year.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

The insurer booked a $950mn policyholder credit expense in September.

-

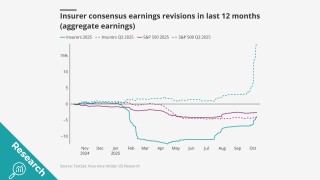

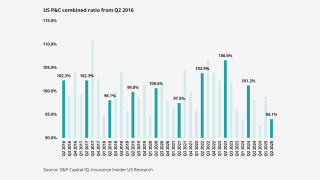

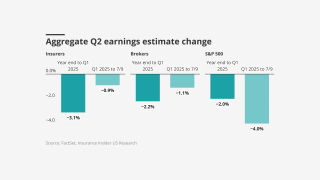

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

When owners are not paying attention, discipline and governance are not top priorities.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

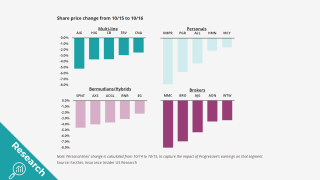

Industry stocks were firmly behind the S&P 500 in Q3.

-

The specialty insurer posted $800mn in GWP for the first six months of the year.

-

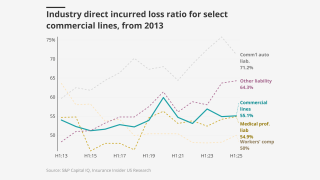

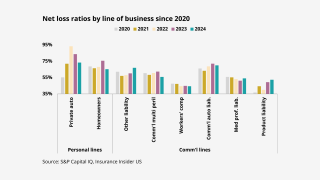

Persistent social inflation challenges evident across key long-tail lines at half-year mark.

-

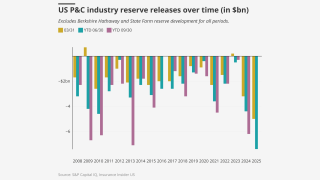

High H1 reserve releases of $7.4bn were driven by the largest of carriers.

-

The firm's risk exchange platform was “highly dependent” on SME and specialty business, CEO Radke said.

-

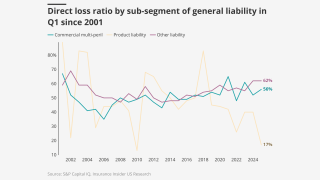

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Profitability improves, even as growth stagnates.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

The insurer said it expects to begin writing business by the end of the month.

-

The company plans to launch in New York and New Jersey next year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive said the floor on D&O pricing is in sight.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

Submissions flow at E&S arm Lexington increased 28% year-over-year in Q2.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

The carrier reported an increase of 82% in pre-tax income.

-

The move will impact around $50mn of gross written premiums in total.

-

Its partnership channel grew three times in new writings year-over-year.

-

Rates continue to fall across the state but are firmer in the southeast region.

-

Social inflation is driving non-renewals, while CoRs are up for P&C and casualty.

-

The carrier sees opportunities to grow in New York, the mid-Atlantic and Florida.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The loss was driven by nat cats and reserve adjustments in US casualty.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

The company also purchased $15mn of SCS parametric coverage.

-

The professional lines market remains ‘challenging’ overall, however.

-

The specialty reinsurer also saw several bad investments hit the books.

-

The carrier’s US redomicile is expected for later this year and brings a one-time $10mn-$13mn benefit.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has also expanded its relationships with US and UK MGAs.

-

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The Canadian insurer saw property rates dip across its global divisions, but it had strong rate on liability.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

The president expects to see benefits from the deal in H2 2026.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

CEO Roche said that “significant price increases” are still to come, however.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The SME and middle market segments remain ‘pretty healthy’.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

Pricing was “virtually flat” in the second quarter.

-

The CEO said business remains adequately priced in most classes.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

The carrier said market dynamics were shifting due to increased capacity.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker posted a 6.5% drop in organic growth YoY.

-

New business written premiums were up in the commercial and E&S segments, but decreased in personal lines.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

Smaller accounts remain less affected by an influx of MGAs.

-

Some E&S business is flowing back to the admitted market but so far it is “anecdotal”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

At least 14 new companies have opened up shop in the state in recent years.

-

Commercial property poses the most intense competition due to rates dropping, terms and conditions, and line size.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

The carrier has been steadily increasing loss trend estimates.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Large accounts property remains competitive as pricing softens, Greenberg said.

-

The carrier's Q2 reserve releases rose to $249mn from $192mn on favorable NA personal development.

-

The carrier’s top line grew to $890m in the first half of 2025.

-

Recent inbound offers can “oftentimes” be a leading indicator that the market is slowing, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

On the rate environment, Schnitzer said the amplitude of the pricing cycle is shrinking.

-

The technology will help analyze growing and emerging risks, especially climate change.

-

Cat losses declined to $927mn from over $1.5bn a year ago on windstorms and hailstorms.

-

Total revenues grew 12% due to the contribution from acquisitions.

-

Social inflation, reserving, and organic growth are the topics to watch this earnings season.

-

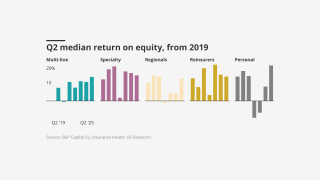

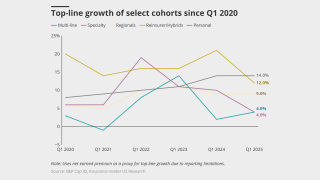

P&C’s outperformance lead dwindles, while specialty rises above other segments.

-

Premium rose across the top 15 P&C risks in 2024.

-

The reinsurance division booked 29% growth for the fiscal year to 30 April 2025.

-

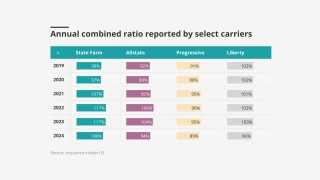

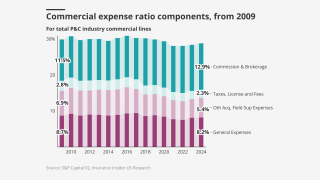

Expense ratios started to move higher in 2024 as the cycle reverses, with this trend likely to persist.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Insurance outperformance slows as markets recover from tariff shock.

-

The reinsurer’s CFO cited a 1.5% net price reduction year to date.

-

Revenue and expenses grew, in part due to the company’s acquisition of Beat Capital Partners.

-

The Bermudian's first quarter cat losses totalled $333.3mn, compared to $103mn a year ago.

-

New CEO Eckert said Conduit had taken “decisive action” after the LA wildfires.

-

Growth in construction projects is increasing the need for coverage.

-

Growth and returns on equity fall, but most of the industry is still profitable.

-

With plenty of reinsurance capacity, CEO Patel said it’s been a “boring year” for treaty negotiations.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The firm expects to replace the volume with Innovations-channel business.

-

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

Hamilton also expects rising demand and stable supply for June 1 renewals.

-

Hits to personal auto, workers’ compensation led to a drop in NWP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

But there’s little concern about those pressures creeping into SME accounts.

-

Older accident years, targeted markets business contributes to adverse development.

-

IGI saw opportunities in energy, ports and terminals and marine cargo but remains cautious in long-tail lines.

-

California homeowners are also expected to move admitted business to E&S.

-

Jack Kuhn, President of Westfield Specialty, discusses the shifting market cycles and changing landscape at RISKWORLD 2025.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Space pricing experienced double-digit increases after the 2023 capacity retreat.

-

The company has reduced its exposure on large commercial auto and property.

-

Sills added that Bowhead doesn't expect a reversal of compressed limits being offered.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

P&C held up better than the S&P 500, but there are causes for longer term concern.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The Canadian conglomerate’s total cat losses in Q1 reached $781mn, including $692.1mn from the fires.

-

The reduction was due to impacts from investments and less favourable PYD.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

The standard market has not ‘meaningfully’ impacted the rate of flow in the aggregate.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The California wildfires in January accounted for $460mn of Q1 cat activity.

-

Customers are demanding more in a larger move towards the E&S market.

-

The company is also pursuing “deconcentration” to lower SCS exposure.

-

But automotive repair costs are likely to increase faster than home repair.

-

Primary and excess casualty in the US saw double-digit rate growth and remained above loss trends in Q1.

-

The remediation process is on track for completion in the fourth quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

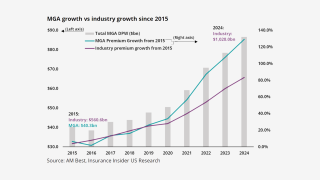

The days of 30%+ growth are probably behind the firm, he said.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

The LA fires and spring storms drove CinFin's CoR up 19.7 points to 113.3%.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The LA wildfires, however, will be the firm’s largest event to date.

-

Q1 rates in most lines were consistent with prior quarters but slightly down on 2024.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

Commercial property premium growth declined 18% in Q1, as rates fell 20%.

-

Renewal rates were favorable compared to what could have happened after several hurricanes.

-

The Hartford’s Q1 CoR increased 4.1 points to 96.9% driven by cat losses.

-

Macroeconomic volatility could also create top-line headwinds.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company will continue to deploy additional limit in property cat through mid-year, the firm’s CUO added.

-

The company’s diverse portfolio could provide protection, but has heavy exposure in construction and transportation.

-

However, the firm will take a “conservative approach” until the improvements are shown in data.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

CEO Marchioni said the overall hit would likely be “in the low single digits”.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Of the $170mn cat losses outside LA wildfires, US cat activity accounted for 74% and international cats 26%.

-

The carrier forecasts stable profits, but tariffs are creating “high uncertainty”.

-

Reserve releases at Chubb rose to $255mn from $207mn a year ago.

-

The legacy carrier reported an operating loss of $45.3mn for the year.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

Guy Carpenter president Dean Klisura added that Q1 was a record cat bond issuance quarter.

-

The growth figure represents a 5-point deceleration on the 9% reported in Q4 2024.

-

A one-time impact would be a mid-single digit increase to physical injury auto severity.

-

The business insurance segment booked a CoR of 96.2%, up 2.9 points YoY.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

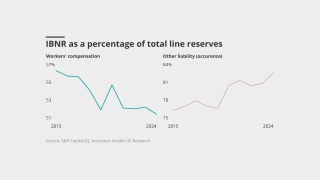

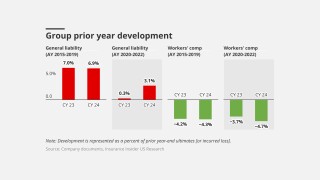

What past trends can tell us about the future of commercial reserving.

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

Growth came across all lines, and losses from catastrophe events were within expectations.

-

Surplus lines are still strong, but not the standout they used to be.

-

The segment’s underwriting results halved to $532mn in 2024 from $1.07bn in the prior year.

-

Its full-year combined ratio for 2024 ballooned to 334.6%, from 124.7% in 2023.

-

The company has seen four straight years of double-digit growth.

-

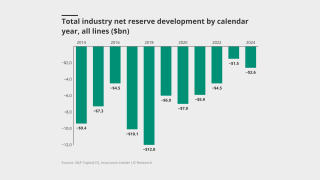

Newly released annual stat filings on reserve data show some troubling trends.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The industry continues to take reserve addition medicine in smaller doses than recommended.

-

Executives see earnings benefits from workers’ comp beginning to diminish.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Underwriting profits for casualty-exposed insurers show signs of struggle as loss costs worsen.

-

Q4 net retention was impacted by the previously announced ADC.

-

The carrier has also received 11,750 fire-related claims so far this year.

-

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Approximately 12% to 13% of Skyward’s premium was in commercial auto in Q4.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Profitability over growth continues to be the company’s “mantra”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

CEO Tim Turner said the firm still has an ambitious M&A pipeline and financial flexibility to execute deals.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company will ‘aggressively pursue subrogation’ for the Eaton Fire.

-

The supply chain in personal auto, and the impact on inflation are areas of concern.

-

Carriers that started earlier in correcting their books and catching up with loss trend may be reaping rewards.