-

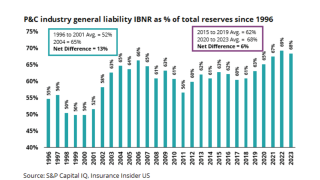

Reinsurers will try to put pressure on insurers for casualty and liability lines, as they did in property.

-

Cat rates meanwhile are seeing downward pressure from 'pricing fatigue’ and limit expansion.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Early results suggest another strong quarter with a variety of driving forces.

-

The US casualty market was “challenging”, the executive said.

-

Property rate increases decelerated to 3% in the quarter.

-

The Q1 figure represents a 2-point acceleration on the 7% reported in Q4 2023.

-

Corrective actions revealed by Travelers in the first-quarter earnings could set the stage for similar moves from peers

-

The HNW carrier will launch in Canada this year, starting with Ontario.

-

The insurer is currently transitioning Corvus' ‘profitable’ $200mn book of business.

-

Underlying improvement was driven by a decrease in the personal lines core CoR.

-

Light cat losses, reserve development, and pricing trends are key topics in Q1.