-

In California, the carrier filed for a 35% increase this quarter after implementing a 6.9% rate hike in April.

-

Market conditions remain “vibrant” with substantial rate increases in property business.

-

AIG decided to buy additional retrocessional protection for Validus Re and a low XoL reinsurance placement for its Private Client Group ahead of the wind season.

-

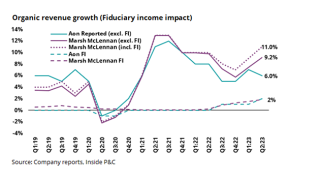

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

AIG grew GI NWP in NA by 17% to nearly $4bn as both commercial lines and personal lines NWP rose 17% to over $3.4bn and $563mn, respectively.

-

Personal auto loss severity rose about 12% year-over-year. The carrier also experienced a “modest” year-over-year increase in frequency of about 1%.

-

Flows to the E&S market remain strong, executives have said, while dislocation in the property space continues to buoy overall pricing conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This resulted in a rate decline of 1% in the company’s specialty business, compared to a 7% increase in the prior-year period.

-

The Inside P&C news team runs you through the earnings results for the day.