-

Global property cat rates were up 30% during the quarter.

-

Losses stemmed from 19 convective storms across multiple states, with hail damage representing the majority of reported losses, primarily impacting the personal lines segment.

-

The insurer’s personal lines business booked over $1bn of cat losses with a $979mn impact on the homeowners' segment, up from $473mn in Q2 2022.

-

The results represent a return to double-digit expansion following three quarters of single-digit growth.

-

Pricing, catastrophes and rising costs are headwinds for this quarter’s insurer results, but brokers should be buoyed by continued inflation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company added that prior and current accident year increases were related to a higher ultimate severity on previously closed claims in its property damage coverages.

-

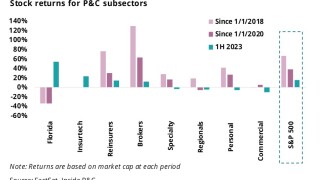

Personal lines underperform predictions, while brokers and InsurTechs are a positive surprise (for now).

-

The carrier experienced a downturn in investment performance during 2022.

-

Antares Re recorded GWP of $854.5mn for 2022, of which $728mn was written in Europe.

-

The legacy carrier reported significant unrealised investment losses.

-

Inside P&C’s news team runs you through the key highlights of the week.