-

The CEO also said Gallagher Re posted a 12% organic revenue growth in Q1 amid the current hardening of the reinsurance market.

-

The carrier booked $185mn in catastrophe losses from winter storms, as well as tornado, wind and hail events across several regions of the US, in line with its preliminary disclosure.

-

Overall, the carrier reported a combined ratio of 100.7% for the quarter, which was 10.8 points higher than the prior year period.

-

Gallagher’s operating earnings per share soared 9.8% to $3.03 – beating analyst consensus of $2.99 earnings per share – in Q1.

-

Arch plans to “take advantage” of these favorable market conditions, and may expand PML to 10%-12% of shareholders’ equity by July 1, from the current 8.1%.

-

The withdrawal from the aviation reinsurance class announced yesterday represented ~$10mn of non-renewed premium.

-

This may slow premium growth but ensure sustainability long term, according to its insurance president.

-

Shares were trading down 6% following the publication of the broker’s Q1 results.

-

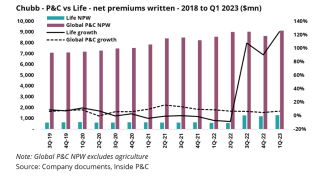

Chubb earnings reveal strategic expansion in Asia and pricing outpacing exposure.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The broker reported new business and increased retention in aerospace, financial solutions and natural resources.

-

Markel also disclosed that its Q1 2022 underwriting results included $35mn of losses attributed to the Russia-Ukraine conflict.