-

The carrier also increased its casualty loss cost assumption to 6% from 5.5%, driven by increased economic and social inflation.

-

The company increased its attachment point on the $200mn aggregate cover to $750mn, up from $700mn.

-

The broker’s president also noted a stabilization in primary pricing outside of property.

-

Commercial risk solutions’ Q4 organic growth dropped 8 points year on year to 4%.

-

CEO Joe Lacher projected that the company will be profitable in the first half of the year and produce an underwriting profit in the second half.

-

Net losses from Winter Storm Elliott included $151mn in commercial lines and $16mn in personal lines.

-

The company booked pre-tax net cat losses of $45.7mn, which included $46.1mn of net losses from Winter Storm Elliott.

-

Public D&O and higher excess liability are two areas where the company is “not quite getting” to where it wants to be in terms of rates, co-CEO Carl Lindner said.

-

On an earnings call Markel’s president of insurance Jeremy Noble spoke to analysts, who are watching loss cost trends closely as rate rises taper.

-

Part of the company's plan to improve auto insurance margins is to file for greater rate increases in 2023, along with lowering operating expenses and advertising spend.

-

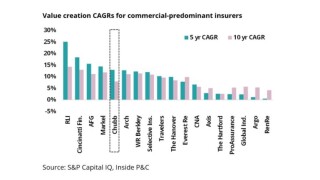

Chubb’s balanced view of the market as a whole, and pricing and loss cost trends in particular, puts it ahead of the curve on value creation, despite a difficult economic backdrop.