-

James River CEO Frank D’Orazio said the firm’s losses from Hurricane Ian will be contained in the third quarter, as he discussed the carrier’s Q3 earnings in a call with analysts.

-

The carrier cited inflation, supply chain issues and labor shortages as the drivers behind an increase in auto loss severity and its third-quarter loss ratio compared to Q3 2021.

-

The company’s combined ratio edged up by 0.3 points despite a two-point reduction in expenses and a 3.4-point reduction in cats.

-

A 3.9-point decline in the casualty and specialty segment offset a 2.5-point deterioration in the company’s property business.

-

The company reported a $5mn loss related to Hurricane Ian, which affected the specialist’s excess property underwriting division.

-

The personal lines unit reported a combined ratio of 107.3%, marking a 3.5-point deterioration from the 103.8% CoR reported in the prior-year quarter.

-

The firm’s North America CoR deteriorated 8.3 points to 114%, but the international division’s CoR improved 13.3 points to 81.4%.

-

CinFin management said premium adjustments for rising costs of building materials are about to double from last year.

-

Meanwhile, Tricia Griffith said the commercial lines business experienced minimal impact from Ian, as physical damage and comprehensive cover are smaller parts of its premium.

-

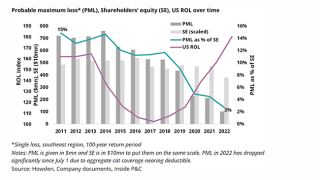

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm’s commercial lines CoR climbed over 18 points to 99% while the personal lines unit’s CoR deteriorated 1.8 points to 104.5%.