-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier reported that $585mn was recorded from auto losses incurred, including boats and recreational vehicles.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The full-year results for 2021 also show the Bermudian start-up held $333mn of net premiums written, as at December last year.

-

The insurer said the overall break-up and sale strategy that represented a $175mn gain was equivalent to 180% of American Reliable’s book value.

-

The industry net loss and LAE ratios decreased 7.3 points year-over-year, while expense ratios improved by 5.9 points.

-

The firm’s leadership said a pattern of strong results is needed before triggering an IPO process.

-

The carrier also reported GWP of just over $2.3bn for the first half of the year.

-

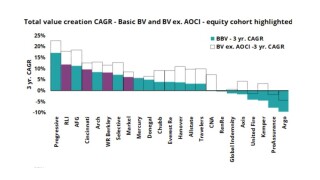

A differentiated investment strategy has led to increased value creation and price-to-book multiples for a small group of specialty carriers.

-

This compared with a $11.4bn loss in the first half of 2021, the report said.

-

ABIR reported that Bermudians posted a total loss ratio of 69.9% and a combined ratio of 100.1% last year.

-

In 2021, the US-Bermudian reinsurance composite’s combined ratio improved six points YoY.