-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

The insurer has been under review with positive implications since March.

-

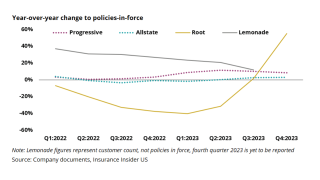

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The company plans to launch in New York and New Jersey next year.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Its partnership channel grew three times in new writings year-over-year.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

The executive has been with the company for roughly one year.

-

The cyber business will continue to operate as a standalone entity.

-

The company said the reduction was due to years of steady improvements.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

The carrier is pricing shares at the upper end of the range announced this month.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

The Floridian is the third insurance company to go public in 2025.

-

The Series C brings the company's valuation to $2.1bn, its highest to date.

-

A week ago, this publication revealed that Slide was pressing ahead with its IPO plans with an S-1 filing.

-

He will also invest in the company.

-

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

The sale price represents Elephant’s approximate net asset value.

-

The specialty insurance platform has now exceeded $3.1bn in premiums.

-

The executive will also oversee premium audit and customer service.

-

The InsurTech was also removed from under review, negative.

-

It makes sense for Next to secure a sale as an exit strategy in an increasingly challenging funding environment.

-

Ahead of the deal, Ergo owned a 29% stake in Next, which generated top line of $548mn last year.

-

The funding round valued the company at around $850mn.

-

Hippo estimated its pre-tax cat loss from the LA wildfires at $42mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Slide lined up Morgan Stanley, Barclays and JP Morgan as lead bookrunners.

-

The company stopped writing new business last September and lost capacity from SiriusPoint.

-

The broker attributed the drop to smaller average deal sizes over the quarter.

-

The investment values Bolttech at $2.1bn and will enhance its global growth strategy.

-

The firm laid off senior leaders this month, weeks after it began pursuing a sale, this publication can reveal.

-

The Bain-backed fronting carrier acquired Spinnaker’s shell subsidiary earlier this year.

-

Funding has reached $3.2bn over the first three quarters, 7% less than in 2023.

-

The company also promoted Eric Biderman to general counsel.

-

The move comes amid improving conditions in the IPO market for insurance companies.

-

The MGA noted a 17%-20% price decline last year and expects similar for 2024.

-

The investment will be used to expand its product portfolio and continue global expansion.

-

Coalition Re to offer active cyber reinsurance via two products supported by Aspen-led capacity.

-

Hippo shares were up 20%, while Root’s shares dropped over 20%.

-

Earlier this year, this publication reported that Jetty was looking for capacity to replace Farmers.

-

The InsurTech’s cat weather loss ratio improved by 83%

-

Lea is responsible for Embroker’s underwriting practices, including paper and reinsurance relationships.

-

A Q3 listing remains a possibility, but the timeline can change rapidly amid storm season.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty and Skyward Specialty.

-

Annual InsurTech funding volume for H1 was $2.2bn, just below $2.3bn for H1 2023.

-

The carrier is looking to grow products with lower cat exposure such as renters and pet insurance.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

BHMS joins a group of Boost backers that includes Markel, Canopius US and management.

-

He will continue to act in his role as COO, global insurance operations.

-

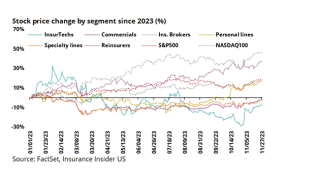

The industry is mostly reluctant to raise capital with high interest rates, except for brokers.

-

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

The program is led by the same carriers as the expiring treaty.

-

Launched in 2021, Axis is both an investor and capacity provider.

-

Previously, the InsurTech only provided coverage in 15 states.

-

The multiline MGA was co-founded by Lea's fellow Vantage alum Farhan Shah.

-

The offering is an admitted product for SMBs and non-profits.

-

Sources said that while a late June-early July IPO is still on the table, a Q4 or early 2025 listing is expected.

-

The program includes all perils coverage and third-event protection.

-

The InsurTech had been pursuing strategic investment options, including a minority stake sale.

-

In 2023, the InsurTech recorded 107% YoY revenue growth and 145% net revenue retention.

-

Arkin Holdings and Launchbay Capital also participated as new investors.

-

AI-centered InsurTechs in Q1 accounted for 28% of all deals in the Global InsurTech report.

-

The company raised $7mn in a Series A in January 2021.

-

The company is understood to be working with Ardea Partners.

-

It is understood that the company needs to secure cash within less than 30 days.

-

Farmers is working with Jetty to help ensure a smooth transition.

-

The company has retained Tony Ursano’s IAP for the raise.

-

Attendees noted the increased presence of service providers and carriers.

-

Hiscox, Intact Ventures, Weatherford and RPM Ventures participated in the fundraise.

-

-

The deal adds to Aspen’s existing support of the InsurTech in the UK and Canada.

-

The agency cited the InsurTech’s material underwriting losses in 2023.

-

This publication revealed that the company was raising capital earlier this year.

-

The InsurTech’s quarterly revenue increased 80.2% to $64.5mn.

-

The InsurTech will push for its services segments as main growth drivers.

-

It’s unsurprising, following the Corvus-Travelers transaction.

-

Fourth-quarter results saw larger profits, but 2024 guidance was subdued.

-

The company has raised a total of $16mn in funding to date.

-

The latest development comes on the heels of the Corvus-Travelers deal.

-

Root’s improved results make it an attractive acquisition, not a comeback story.

-

The InsurTech’s shares gained over 50% in value on Thursday.

-

In September 2023, Cowbell made the same number of staff cuts.

-

The price movement came amid a tech stock rally on Wall Street.

-

The company posted favorable development in the last quarter of 2023.

-

Bill Fahrner most recently served as CUO at Joyn Insurance.

-

The company’s book is being run off by Boost Insurance.

-

The company would ideally like to target a minority investment.

-

The company provides a platform for brokers to value, buy and sell books of business.

-

The company's reinsurance panel has expanded to over a dozen risk capital providers.

-

Intact Ventures, Era Ventures, Greenlight Re and Spark Capital also participated.

-

The home insurance start-up claims the fundraise was made at a $1bn-plus valuation.

-

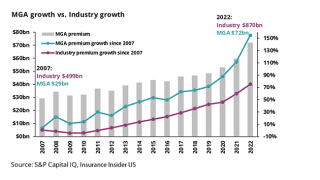

Funding dropped from $8bn in 2022 to $4.5bn in 2023, a 43.7% decrease.

-

Koffie began work on a sale earlier this month following major layoffs.

-

It is understood that the InsurTech began fundraising late last year.

-

The parties also signed a release of claims arising from the Vesttoo fraud.

-

The company also increased participating reinsurers to 19 from 14.

-

The motion was filed by Chaucer Insurance Company and Chaucer Syndicates, as managing agent of Lloyd’s Syndicate 1084.

-

The company announced it is undertaking several strategic steps designed to increase operational and capital flexibility and to better position it for future growth opportunities.

-

It is understood that the cyber InsurTech has ~$100mn of excess delegated authority capacity and around 20 backers.

-

The firm’s primary coverage includes general liability, workers’ comp, professional liability, umbrella and inland marine, according to its website.

-

A Branch spokesperson cited persistent inflation as a “significant challenge for home and auto insurance companies” and the reason for the staff reductions.

-

If the Floridian goes through with a listing, it will be a true test of whether the public markets believe that the state’s fragmented insurance market is fixed, or on its way to being so.

-

Sources said the fast-growing homeowners' Floridian is finalizing the process to retain investment banks with the aim for an equity event to take place in the first half of the year.

-

In her new role, Kozel will lead all sales and distribution efforts for Cowbell east of the Mississippi.

-

The announcement closes the $435mn-deal which was announced in early November.

-

2024 is likely to be another challenging year for the industry, and commercial in particular, though improvement in personal lines may soften the blow.

-

The decision is based on the belief that the clarity provided under the old structure outweighs the benefits of the co-CEO structure that was put in place two years ago.

-

The “convenience claims” route to payout will be limited to claims up to $200,000.

-

Mulberri will use the capital to expand its small and medium enterprise offerings, serving the risk needs of SMEs.

-

The executive joins Cover Whale after over two years at Bermudian SiriusPoint, where he was EVP and global CTO.

-

The new trade organization seeks to promote responsible use of technology, collaborate with regulators on consumer protection and make insurance more available, affordable and accessible.

-

The latest short interest data shows continued pessimism on InsurTechs and Florida insurers.

-

Oliver Bäte joins Bret Johnson, CFO of SpaceX, and Coalition co-founders John Herring and Joshua Motta on the board of directors.

-

Sources agree that there are others that could follow a similar playbook, but there are three key considerations to keep in mind when pursuing a strategic-on-InsurTech transaction.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

A quick roundup of this week’s biggest stories.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The Insurance Insider US Research team walks buyers through valuation considerations for InsurTech MGAs, as capital constraints point to further consolidation.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The company distributes insurance through leading national commercial broker partners and currently focuses on manufacturing, agriculture and the construction industry.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company is now open to accepting homes up to 75 years old, and future effective date requirements have been reduced to one day.

-

Under the agreement, reached late on Monday, Vesttoo would sell its assets in a transaction that would close by December 1, 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The challenging funding environment has left InsurTechs with limited options for capital raising and liquidity.

-

The transaction is expected to close in the first quarter of 2024, subject to regulatory approvals.

-

The pendulum that swung towards a focus on growth for the past few years is now swinging towards profitability and increased partnership.

-

The decision to pull back from some business in the meantime will cause “additional [total gross premium] declines in 2024,” the executive said.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Following its earnings report on Wednesday, Lemonade’s stock hit $14.80 per share on Thursday morning, nearly 35% higher than the previous close and the highest since mid-August.

-

“We're certainly not banking on inflation abating at this moment in time,” Alex Timm told analysts.

-

The beleaguered firm claims its creditors are unsympathetic around delays due to the Israel-Hamas conflict.

-

Increased private investments by (re)insurers have been a “theme of the year” according to Johnston, who described the year as “one of consistency.”

-

The InsurTech announced a strategic partnership with Allstate to combine the companies' expertise in small business insurance, and a stronger reinsurance relationship with Allianz.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

There is a “confluence of factors” making the current raising environment more challenging for companies, the CEO said.