-

Attorneys and doctors targeted by the case claim Uber has no standing to bring a Rico suit.

-

The proposal says oil companies cause climate change and, thus, increased cat losses.

-

A motion to dismiss argues the case should not have been filed in federal court.

-

Fleming Re bought the James River Re legacy book in 2024.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

The legal setback came as publication of a Fema reform report was postponed.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

The Republican said his office has launched an investigation into the denials.

-

Ford had purchased a builder’s risk policy from the insurer.

-

The years-long legal battle was brought on by a former employee alleging wrongful termination.

-

The PE fund says Argo failed to indemnify it for costs related to a probe by New York’s attorney general.

-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

The insurer says defendants billed “exorbitant” fees for non-existent services.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

The company had argued the judge missed key info when dismissing the case.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

A string of high-profile bankruptcies has put more scrutiny on the once marginal sector.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

A jury awarded $32.3mn for repair costs, and $80mn for business interruption.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

GC continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

The plaintiffs' bar has been playing out the same rulebook for 15 years. It’s time the defense catches up.

-

A motion by defendants to dismiss the case was also denied.

-

Many nuclear verdicts become much less radioactive on appeal.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The fashion brand says the insurer failed to defend it in multiple lawsuits.

-

The dismissal comes after the judge in the case had stayed it just a day earlier.

-

The defendant held a $1mn general liability policy with Kinsale.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

Marsh is also suing a second tier of former Florida leaders.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

Critics claim the dispute system denies consumers' key legal rights.

-

The motion claims the New York court has no jurisdiction in the case.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

A US district judge ruled a delay could put human life and property at risk.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

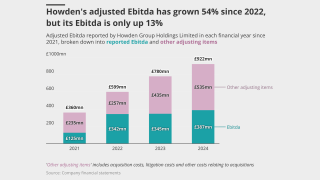

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

AIG’s filing alleges copyright and trademark breaches, as well as violations of unfair business practice laws.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

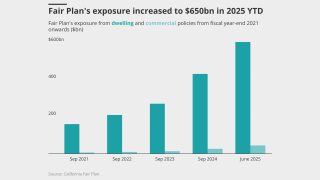

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The case is now headed to appellate court.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The broker has filed a motion to dismiss the lawsuit by Marsh.

-

James River said the court was right to dismiss the fraud case.

-

The company said defendant "distraction" can’t make up for flimsy arguments.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

Hasnaa El Rhermoul will be SVP at Ethos Transactional, sources said.

-

The lawsuit is the third filed by MMA against Alliant in the past year.

-

Parrish, now CEO of Howden US, and his colleagues said they didn’t violate contracts.

-

The Delaware high court’s reasoning could find application in other cases.

-

A key hearing in the poaching case is set for September 4 in New York.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

The company said the judge overlooked key issues in dismissing its fraud case.

-

The company was hit with a data breach on July 16.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The firm’s subsidiary in India paid $1.47mn in bribes to officials at state-owned banks and raised revenue of $9.2mn.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The automaker’s insurance arm wrote over $300mn in premium last year.

-

The executive said the claims industry is going to “be transformed”.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

Large accounts property remains competitive as pricing softens, Greenberg said.

-

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

The insurer denies it is responsible for the actor’s legal fees.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

The alleged insurance fraud targeted anyone who could fund the settlements, argued the plaintiffs.

-

The judge ruled the deal relied too heavily on Bermuda law for US law to apply.

-

The class can collectively challenge State Farm’s property claims calculations.

-

The suit claims billions of dollars are being illegally withheld.

-

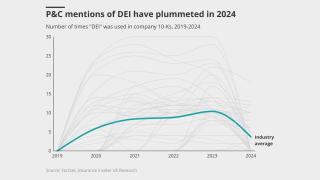

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

He has pleaded not guilty to the criminal charges, which carry potential life sentences.

-

The broker also alleges a coordinated effort undermine client confidence.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

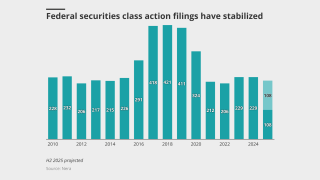

At the year’s mid-point, there were 111 new SCAs filed in federal courts.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

Under the new law, vehicles will only be required to carry $100,000 in PIP per person.

-

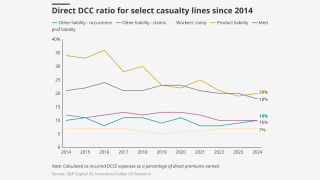

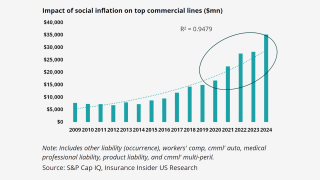

Litigation costs continue to weigh on long-tail lines, but effects of tort reform are visible.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

The MGA and parent company Roosevelt Road Re have until July 21 to file a second amended complaint.

-

The rules would require paid rest breaks, among other measures.

-

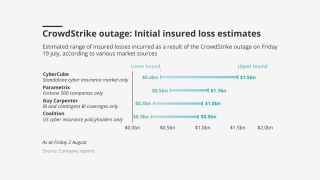

It didn’t have a major impact on insurers’ finances – instead, it served as a wake-up call.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

Lara approved an interim rate increase for the company just weeks ago.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

Chubb told insurers to look inward in the fight against LitFin, but insurers are also tied to that industry.

-

The documents figure in a potential criminal case against a CCB employee.

-

The regulator said further measures could still be passed in this session.

-

The panel aimed to highlight “synergies” between insurance and litigation finance.

-

Companies often purchase policies with limits far exceeding their actual exposure needs.

-

One measure could give regulators greater leeway to deny rate requests.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

The two parties seek to delay a judge’s summary judgment order.

-

Previous complaints alleged their involvement, but this is the first time a complaint has identified the alleged funders.

-

Litigation funding is a frequent bogeyman for the insurance industry. The feeling isn’t mutual.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

The reforms limit liability for some small businesses in the state.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

The conference came at a particularly tumultuous time for the US insurance industry and the economy at large.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The impact could also raise home-building costs by $10,000 per unit.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

A first-of-its-kind resolution adopted this week says subrogation can reduce insurance costs.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

The law imposes limits on third-party litigation funding, among other changes.

-

The suit seeks to block insurers from passing through assessment costs.

-

The release followed the filing of an updated Plan of Operation.

-

The suit alleges a “deliberate scheme” to deny smoke damage claims.

-

The larger awards over the past two years could serve as an anchor for future verdicts.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

This is shaping up to be a record year, building on momentum in 2024.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

The amount of change over the past year falls short versus the discourse.