-

The legal setback came as publication of a FEMA reform report was postponed.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

The Republican said his office has launched an investigation into the denials.

-

Ford had purchased a builder’s risk policy from the insurer.

-

The years-long legal battle was brought on by a former employee alleging wrongful termination.

-

The PE fund says Argo failed to indemnify it for costs related to a probe by New York’s attorney general.

-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

The insurer says defendants billed “exorbitant” fees for non-existent services.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

The company had argued the judge missed key info when dismissing the case.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

A string of high-profile bankruptcies has put more scrutiny on the once marginal sector.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

A jury awarded $32.3mn for repair costs, and $80mn for business interruption.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

GC continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

The plaintiffs' bar has been playing out the same rulebook for 15 years. It’s time the defense catches up.

-

A motion by defendants to dismiss the case was also denied.

-

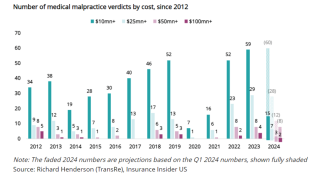

Many nuclear verdicts become much less radioactive on appeal.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The fashion brand says the insurer failed to defend it in multiple lawsuits.

-

The dismissal comes after the judge in the case had stayed it just a day earlier.

-

The defendant held a $1mn general liability policy with Kinsale.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

Marsh is also suing a second tier of former Florida leaders.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

Critics claim the dispute system denies consumers' key legal rights.

-

The motion claims the New York court has no jurisdiction in the case.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

A US district judge ruled a delay could put human life and property at risk.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

AIG’s filing alleges copyright and trademark breaches, as well as violations of unfair business practice laws.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

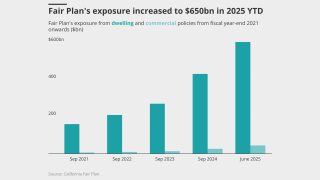

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The case is now headed to appellate court.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

The broker has filed a motion to dismiss the lawsuit by Marsh.

-

James River said the court was right to dismiss the fraud case.

-

The company said defendant "distraction" can’t make up for flimsy arguments.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

Hasnaa El Rhermoul will be SVP at Ethos Transactional, sources said.

-

The lawsuit is the third filed by MMA against Alliant in the past year.

-

Parrish, now CEO of Howden US, and his colleagues said they didn’t violate contracts.

-

The Delaware high court’s reasoning could find application in other cases.

-

A key hearing in the poaching case is set for September 4 in New York.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

The company said the judge overlooked key issues in dismissing its fraud case.

-

The company was hit with a data breach on July 16.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The firm’s subsidiary in India paid $1.47mn in bribes to officials at state-owned banks and raised revenue of $9.2mn.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The automaker’s insurance arm wrote over $300mn in premium last year.

-

The executive said the claims industry is going to “be transformed”.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

Large accounts property remains competitive as pricing softens, Greenberg said.

-

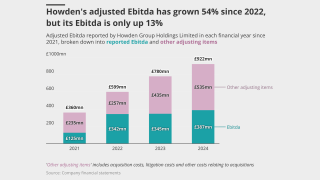

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

The insurer denies it is responsible for the actor’s legal fees.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

The alleged insurance fraud targeted anyone who could fund the settlements, argued the plaintiffs.

-

The judge ruled the deal relied too heavily on Bermuda law for US law to apply.

-

The class can collectively challenge State Farm’s property claims calculations.

-

The suit claims billions of dollars are being illegally withheld.

-

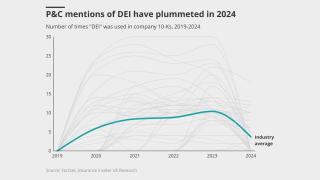

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

He has pleaded not guilty to the criminal charges, which carry potential life sentences.

-

The broker also alleges a coordinated effort undermine client confidence.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

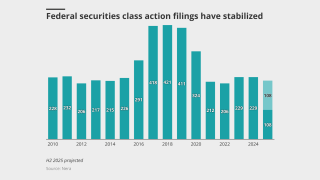

At the year’s mid-point, there were 111 new SCAs filed in federal courts.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

Under the new law, vehicles will only be required to carry $100,000 in PIP per person.

-

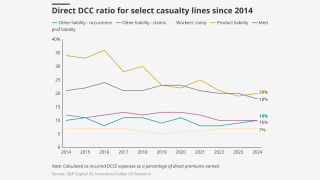

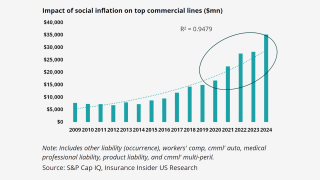

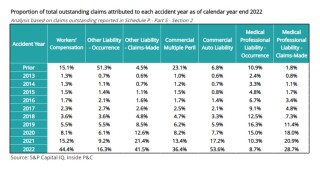

Litigation costs continue to weigh on long-tail lines, but effects of tort reform are visible.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

The MGA and parent company Roosevelt Road Re have until July 21 to file a second amended complaint.

-

The rules would require paid rest breaks, among other measures.

-

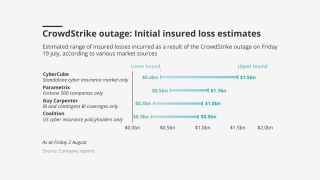

It didn’t have a major impact on insurers’ finances – instead, it served as a wake-up call.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

Lara approved an interim rate increase for the company just weeks ago.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

Chubb told insurers to look inward in the fight against LitFin, but insurers are also tied to that industry.

-

The documents figure in a potential criminal case against a CCB employee.

-

The regulator said further measures could still be passed in this session.

-

The panel aimed to highlight “synergies” between insurance and litigation finance.

-

Companies often purchase policies with limits far exceeding their actual exposure needs.

-

One measure could give regulators greater leeway to deny rate requests.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

The two parties seek to delay a judge’s summary judgment order.

-

Previous complaints alleged their involvement, but this is the first time a complaint has identified the alleged funders.

-

Litigation funding is a frequent bogeyman for the insurance industry. The feeling isn’t mutual.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

The reforms limit liability for some small businesses in the state.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

The conference came at a particularly tumultuous time for the US insurance industry and the economy at large.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The impact could also raise home-building costs by $10,000 per unit.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

A first-of-its-kind resolution adopted this week says subrogation can reduce insurance costs.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

The law imposes limits on third-party litigation funding, among other changes.

-

The suit seeks to block insurers from passing through assessment costs.

-

The release followed the filing of an updated Plan of Operation.

-

The suit alleges a “deliberate scheme” to deny smoke damage claims.

-

The larger awards over the past two years could serve as an anchor for future verdicts.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

This is shaping up to be a record year, building on momentum in 2024.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

The amount of change over the past year falls short versus the discourse.

-

Capital funding new litigation dropped 16% YoY, however.

-

The bill being considered would effectively eliminate personal injury protection.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

Defendants claim that Tradesman lacks standing to bring the case.

-

The judge noted similarities in Dellwood’s business plan and AIG’s.

-

Both bills are now on Governor Kemp’s desk awaiting signatures.

-

The Georgia verdict is one of many legal battles over Monsanto’s herbicide.

-

What insurers can learn from the history that led to this deal.

-

The commissioner is eyeing transparency in billing, comparative fault and non-economic damages changes.

-

The regulatory changes have been championed by Governor Brian Kemp.

-

The lawsuit alleges that the attorneys' negligence caused HDI to pay 64 times its policy limit.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

There are signs that Florida’s insurance industry is coming under increasing legislative scrutiny.

-

The industry needs to find a way to rebalance power dynamics.

-

The carrier has seen increased legal system abuse in US small commercial and excess and umbrella.

-

The insurer claims Jessica Balsam still holds Zurich confidential information.

-

Big tort reform packages are on the table, but California steals the show, for now.

-

The plaintiff claims he was fired after testifying to anti-gay harassment.

-

The proposed reforms are championed by Governor Brian Kemp.

-

Berkshire Hathaway’s "float" rose to $171bn in 2024 from $169bn in 2023 as Buffett praised Geico’s Todd Combs.

-

Commissioner Lara calls the 10 bills a ‘comprehensive legislative package.’

-

At the first Insurance Insider US Miami Forum, Floridian industry players pointed to signs of stability.

-

Subsidiaries of Chubb, AIG, Travelers and The Hartford were all named in the lawsuit.

-

The decision allows a $4bn settlement, threatened by insurer claims, to proceed.

-

The suit accuses CEO Brian Cornell and other Target executives.

-

The restructuring arrangement is designed to protect creditors.

-

Anti-DEI shareholder activist groups are targeting directors and officers with increasing threats of litigation.

-

James Keating received 20 months in prison and three years of supervised release.

-

The AIG subsidiary says it has no obligation to “defend or indemnify” McKinsey.

-

The complaint accuses a new law firm, Liakas Law, of involvement in a fraud scheme.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

III also denies its CEO made anti-gay remarks or harassed a gay employee.

-

Federal court securities class actions hit a four-year high last year.

-

California’s crisis spurred the biggest reforms in decades.

-

A California ruling could set an important precedent as other courts consider similar cases.

-

A former executive claims he was terminated for reporting that III CEO Sean Kevelighan used homophobic slurs.

-

The suit seeks compensatory and punitive damages from 180 defendants.

-

The Federal Insurance Office has data collected from over 300 insurers.

-

The regulations are part of a state effort to expand wildfire coverage.

-

Ohio’s Supreme Court unanimously said the abatement fund isn’t covered by the paint maker’s insurance policies.

-

The defendants allegedly issued more than 40 unauthorized insurance policies.

-

Weiss Ratings has claimed that insurers are short on reserves and deny legitimate claims.

-

A jury found the retailer defamed a former driver with false claims of workers’ compensation fraud.

-

A separate US Chamber of Commerce report, meanwhile, put tort costs at $529bn for 2022.

-

Insurers and their allies hope to capitalize on increased attention to pass a slew of reforms.

-

The recently filed suit names several personal injury law firms.

-

Mr Cooper Group said it was the target of a 2023 hacking attack.

-

The lawsuit involves an alleged $100mn+ Ponzi scheme.

-

Sinclair had $50mn in coverage through five separate cyber policies.

-

The airline says the crash resulted in over $500mn in losses.

-

Fleming alleges fraud and misrepresentations on the part of James River.

-

Plaintiff Ionian has alleged a “fraudulent scheme” under the Rico laws.

-

The plaintiff claims he was terminated for testifying to anti-gay harassment.

-

The looming collapse of the city’s biggest livery insurer may not be cause for national concern.

-

Current efforts to battle third-party litigation funding are focused on disclosure.

-

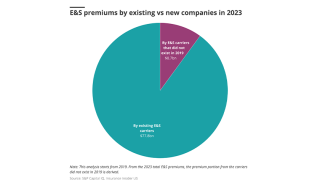

A large number of new entrants and the growth of litigation finance challenge E&S enthusiasm.

-

Insurers are fighting to recoup claims they have paid out.

-

The former Lockton employee’s suit alleges sexual and gender harassment.

-

The lawsuit alleges the data is being used by insurers to increase premiums.

-

The insurer said Dellwood’s "spin" isn’t enough to dismiss the litigation.

-

The lawsuit names additional attorneys, doctors and medical practices.

-

Greg Lindberg owned four North Carolina-domiciled insurance companies.

-

White Rock claims CCB was responsible for the “lion’s share” of fraudulent letters of credit.

-

The lawsuit demands coverage from insurers following opioid and product liability-related settlements.

-

States are grappling with first responder claims litigation as some move to expand presumptions to more worker types.

-

A lawsuit filed last month by a former employee alleged sexual and gender harassment.

-

While the alleged fraud is shocking, could it suggest the industry is under-investing in claims?

-

The decision comes weeks before the rule was set to take effect in September.

-

The suit also charges the agents with unjust enrichment and contract breach.

-

The ruling only applies to a Florida retirement community.

-

Independent litigation threatened a $4bn settlement with wildfire victims.

-

Lawsuit claims GM unlawfully sold data to insurers collected from 1.5m drivers.

-

Researchers say if this pace continues, 2024 will see approximately 224 cases.

-

James River will also oppose a Fleming motion to uncover additional documents.

-

Insurers and victims must reach an agreement on how to handle the proceeds.

-

The unsafe products were sold on Amazon’s marketplace by third-party sellers.

-

Three states passed restrictions on commercial litigation funding in 2024.

-

The judge relied heavily on a previous UK court decision.

-

NatGen allegedly collected $500mn associated with the fraud.

-

The proposed class says the plan does not cover smoke damage.

-

The first RICO complaint targeted medical providers and training centers.

-

The victims claim insurers shouldn’t get settlement cash before they’re made whole.

-

Lockton EVP Matthew Simmons was ordered to pay $1.9mn of the total award.

-

Fleming files claims against James River, its CEO Frank D’Orazio and group CFO Sarah Doran.

-

The plaintiff is seeking damages in excess of $35,000 as well as a trial by jury.

-

-

A draft bill would require the disclosure of third-party financing in federal courts.

-

AIG says new details support case that former execs launched Dellwood using confidential business information.

-

This follows AIG’s voluntary dismissal of claims against Dellwood’s top execs.

-

Beazley has two days to amend its complaint, correcting jurisdictional deficiencies.

-

The Bermuda courts will assess Onex’s lower, revised offer for the fronting unit.

-

AIG is maintaining its initial 'unlawful misappropriation' suit against Dellwood.

-

Of that total, $312.5mn was allocated to resolve the PFAS claims.

-

Ten companies have filed a 0% increase and at least eight companies have filed a rate decrease to take effect in 2024.

-

The carrier’s comments on claims severity should serve as a warning for the industry

-

Verdicts awarding more than $100mn hit a new high of 27 last year, study finds.

-

The plaintiffs – three former claims adjusters – were each awarded $25mn in punitive damages.

-

The agreement from Fleming to honour original terms still leaves it open to long-term damage.

-

NFP claims it has so far lost five clients to Alliant, resulting in damages of $2mn.

-

Fleming had attempted to land ~$78mn in ‘economic concessions’ on the deal.

-

Ten states joined in the original suit.

-

The global insurer also alleges breach of contract and fiduciary duty in the federal suit.

-

Altamont-backed Fleming says it remains willing to acquire JRG Reinsurance.

-

The six execs left Acrisure for rival broker Woodruff Sawyer in March.

-

PCF claims it overpaid the first year earnout by over $19mn in the $226mn acquisition of Rice.

-

Demand for funding is still seen as robust, however.

-

Lockton broker Gary Giulietti said the size of the bond is "rarely, if ever, seen".

-

The agency will track the potential impact of the lawsuit on James River’s ratings.

-

James River sued Fleming yesterday to enforce the $277mn sale of its casualty re unit.

-

Fleming has claimed breach of contract and is seeking roughly $78mn in “economic concessions”.

-

Procedural expenses in the case have been as high as $100,000 per day.

-

Vesttoo is unable to make a similar request again.

-

The probe concluded in Q4 last year, according to Gallagher’s 10-K.

-

The committee claims Chaucer waited until it had ‘maximum leverage’ over other debtors.

-

As last year’s reforms shake out, only a few changes are pending for 2024.

-

Rates are generally cheaper than the admitted market.

-

The syndicate is suing its reinsurers to cover Covid-19-related claims in California, Colorado, Florida, Illinois, Nevada, New York and the UK.

-

In total, insurers paid indemnity of $11bn and loss adjustment expenses of $1.5bn for claims closed in 2022.

-

The 11th hour settlement came just days before the case was scheduled to be heard by the New Jersey Supreme Court.

-

Thursday’s announcement means that the Russian insurer is off the hook for claims proceedings.

-

The reforms are working for claims filed after December 2022, but attorneys are still litigating claims filed prior to the legislation.

-

The “convenience claims” route to payout will be limited to claims up to $200,000.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

The DoJ also hit rival reinsurance broker Tysers with a $36mn penalty and administrative forfeiture of around $10.5mn.

-

The probe determined that Syed Baghdadi and Gator falsified information and misappropriated premiums, leaving multiple customers uncovered.

-

Chief of IRS Criminal Investigation said Tysers had "eroded the process of fair and open competition".

-

The Trustee had sought to accelerate the liquidation process while avoiding significant admin costs.

-

Under the agreement, reached late on Monday, Vesttoo would sell its assets in a transaction that would close by December 1, 2023.

-

The beleaguered firm claims its creditors are unsympathetic around delays due to the Israel-Hamas conflict.

-

In a motion filed Friday, the trustee requested to convert Vesttoo’s Chapter 11 case to Chapter 7 so that “an independent fiduciary can wind down the debtor’s affairs and avoid significant administrative costs”.

-

Earlier today, in a bid to accelerate liquidation, the company’s unsecured creditors requested early termination of the exclusivity period granted Vesttoo to develop a reorganization plan.

-

Doing so would save “at least $8.5mn in cash” based on the firm’s monthly operational expenditures, according to a recent motion.

-

Creditors already have authorisation to access Vesttoo’s data as part of their investigation.

-

Last week, this publication revealed that Howden agreed to pay Guy Carpenter in excess of £50mn ($61mn) to settle the poaching suit related to Massimo Reina and a defecting European team.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Damages following the departures are estimated at $15mn, based on the fact that the transaction solutions team’s average monthly profit was $1.67mn between 2022 and 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The motion seeks discovery of information and documents about the structure and operation of White Rock’s cells.

-

The payment represents the largest ever made in a team lift case in the London market.

-

An internal missive, seen by Insurance Insider, also revealed Howden has agreed to a ‘set of demands to make amends’ in the wake of poaching settlement.

-

Kenneth Gould and Frank Scardino resigned “effective immediately” in early October to join WTW, allegedly forgoing a required 30-day notice period.

-

The two rival brokers have reached an out-of-court settlement over the poaching of 38 Guy Carpenter staff by Howden.

-

Scott Canales, Richard Roderick, and Greg Barnes will join as executive vice presidents, and Mark Racunas as senior vice president, of Alliant Specialty.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Avenue Capital-backed Greylag claimed that insurers denied coverage of the two lost aircraft, which have a value of nearly $110mn and $120mn, respectively.

-

A summary of commentary from the second day of Inside P&C New York, with insights on InsurTechs, MGAs and Vesttoo.

-

The Orlando, Florida-based brokerage filed a complaint last week in a South Carolina court, saying the clients being solicited represent over $8mn in annual revenue.

-

The InsurTech claims five former staff, including the CEO and CFO, forged signatures and impersonated bank staff.

-

In the initial court documents, Aon alleged its rival broker and former head of PFI “conspired unlawfully” to recruit key members of the team.

-

Court filings indicate use of “phony phone numbers” and creation of a “wholly fictitious person” in the letters of credit fraud that has engulfed Vesttoo.

-

For the casualty and property programs the Archdiocese paid nearly $2.2mn collective annual premiums each, court records reviewed by Inside P&C show.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

A committee of unsecured debtors was appointed, including Markel, Clear Blue, Porch’s HOA, United Automobile Insurance and Proventus.

-

The Aon transformer is seeking information on the origins of alleged fraudulent letters of credit.

-

The Aon unit noted 37 LOCs “purportedly procured by China Construction Bank (CCB), Banco Santander and Standard Chartered Bank US”.

-

The company’s Monday statement is the latest development in a debacle that could potentially lead to a major loss event for the utility company’s casualty insurers.

-

Vesttoo has filed documents at the Bankruptcy Court for the District of Delaware that seek an automatic stay against White Rock and its putative liquidators.

-

The company's Ebitda for 2022 was estimated at $60mn compared to $20mn in 2021.

-

The settlement would resolve claims that Allstate defrauded shareholders by underreporting “skyrocketing” auto claims to artificially boost the stock price, which later crashed.

-

The firm’s interim CEO Ami Barlev has argued that, with Vesttoo’s weekly expenses being $360,000, freezing assets above $1m would be “catastrophic for the company”.

-

The ILS transformer platform claims Vesttoo is in breach of shareholder agreements.

-

The co-founders will be on paid leave until a final decision is taken.

-

The broker said it believes it has meritorious defenses and intends to vigorously fight the claims and seek recourse against third parties where appropriate.

-

The fronting company said impairment to Vesttoo’s LoC collateral will be "immaterial".

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The suit is related to the violation of a non-disclosure agreement between the parties.

-

The supply-chain finance firm dramatically collapsed in 2021 after its trade credit insurance was pulled.

-

The bishop’s insurance policies include general liability coverage, auto, employment practices, E&O, D&O, excess liability, cyber and sexual misconduct.

-

The three former USI employees were held liable for breach of contract after violating non-solicitation clauses.

-

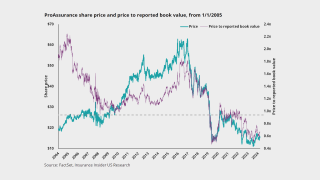

With social inflation increasing since Covid, ProAssurance’s recent announcements could be the tip of the iceberg for older claims in the industry.

-

The broker said it intends to vigorously defend itself against Aon’s allegations concerning the departure of fac re employees.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The companies filed the motion with prejudice, barring them from bringing the same arguments to another US court in the future.

-

Aon claims that Alliant has poached around 32% of Aon’s facultative reinsurance group, including 18 of the 25 Aon employees in the casualty fac team at all levels.

-

During the first quarter, Chubb paid $200mn and another $300mn last month, according to the company’s Q1 10-Q filed with the SEC.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The insurer made the payment on April 20, according to SEC filings reviewed by Inside P&C.

-

The impact of recent tort reforms is already being felt in the Sunshine State, the CEO said.

-

One question in the community is whether nuclear verdicts this year will spark a re-acceleration of rates, especially in the lead excess layers.

-

The carrier cited a “huge” spread of possible outcomes from various lawsuits relating to aviation claims from the conflict.

-

US District Judge Richard Andrews struck down the arguments by some insurers that the judgment inflated claims and contained factual errors.

-

For years, Florida attorneys have utilized one-way attorney fees and assignment of benefits to bleed the insurance market of thousands of dollars.

-

The companies did not disclose whether any money exchange hands as part of the agreement.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The lawsuit argues that one engine that was leased out in Ukraine and 16 engines that were leased out in Russia have suffered physical loss or damages.

-

The payment followed a $200mn disbursement that Chubb made in Q3. The insurer expects to cover the remaining $500mn of the liability in 2023.

-

After threatening a swathe of downgrades of Floridian carriers last year, the ratings agency has signaled a positive reception of reforms.

-

A canvass of Florida executives by Inside P&C suggests glimmers of an improved claims environment ahead.

-

The InsurTech is accusing Brinson Caleb Silver and his alleged co-conspirators of executing a scheme which defrauded it of at least $9.4mn.

-

The cases were filed in California and Florida courts, states where non-competes are currently treated differently, and followed the FTC’s move to ban them.

-

In addition, Lloyd's syndicates Atrium and Syndicate 1183 asked the judge to dismiss the case against them in its entirety.

-

AmFed’s Pie Development alleges that Pie co-founders Dax Craig and John Swigart misappropriated trade secrets which led to the founding of the InsurTech.

-

Louisiana governor John Bel Edwards, state insurance commissioner Jim Donelon, and legislative leadership are in discussions about a potential special session.

-

In each case, the broker asked the judge to dismiss with prejudice, barring the parties from bringing the disputes to another US court.

-

All claims in the case were dismissed with prejudice, barring the parties from bringing the dispute to another US court.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The broker argued that WTW conspired with former employees Terry Rolfe and Daryl Abbey to use its confidential information and divert customers to WTW.

-

While the new legislation will likely bear fruit in 12-24 months, insurers must first pass the hurdle of 6.1 renewals amid higher reinsurance pricing and limited availability.

-

On Tuesday, the bill passed in the State Senate 27-13, and today's passage in the House represented an 84-33 party line split.

-

The bill under discussion tackles key concerns like eliminating one-way attorney fees and getting rid of the state’s controversial assignment of benefits right.

-

The company settled 364 claims related to vehicle theft reporting, resolving over 95% of its pending theft reporting claims.

-

The state’s lawmakers will meet on December 12-16 to address the challenges facing its troubled property insurance market.

-

Employers this year have grappled with landmark decisions from the Supreme Court and the passage of significant employment laws, the broker said.

-

The lessor is looking to recoup $750mn from its war insurers or over $875mn from its all-risk insurers, in the event that its war claim fails.

-

The amount Aircastle is looking for in the suit is, however, lower than the $350mn insurance claim that for equipment stranded in Russia.

-

The Q3 settlement gain of $35mn net of litigation costs and taxes will be recognized in Q4, SEC filings show.

-

The US DoJ is seeking information related to Gallagher's insurance business with public entities in Ecuador.

-

The insurer expects to pay the remaining $600mn liability within the next 12 months.

-

The brokers asked the judge in the case for a 30-day extension to finalize settlement terms in Aon’s suit against WTW.

-

The Massachusetts Bay Transportation Authority claims the firms failed to act over the bankruptcy of LMH-Lane Cabot Yard Joint Venture.

-

Argo Group has been sued by investors, who claim the company has engaged in inadequate underwriting and misrepresentation of facts which resulted in a 60% drop in the specialty carrier’s common stock value this year.

-

A study by the (re)insurer has found that pandemic-induced state court backlogs could take between 1.5 and three years, depending on how fast pending cases are cleared.

-

Both lawsuits and counterclaims were dismissed with prejudice, barring the brokers from bringing the disputes to another US court.

-

Ambac Financial Group has entered into an agreement to settle claims against Bank of America (BofA) for $1.84bn, putting an end to a 12-year lawsuit which dates back to the 2008 mortgage crash.

-

Executives Peter Barbara and John Drew seek monetary relief of more than $1mn, filings show.

-

The carriers appealing the settlement include AIG’s Lexington Insurance, Travelers, Allianz Global Risks, Liberty Mutual, GenStar, Munich Re, Argo and Old Republic.

-

The brokers are working on finalizing the terms in a written settlement agreement, which could be filed within two weeks.

-

The attorney joins Clifford from Sidley Austin's insurance and financial services group, where he worked for 15 years and was a partner prior to his move.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The 222-page complaint describes fraud committed against various carriers, including Zurich, Tokio Marine and Everest in surety, D&O and homeowners’ insurance programs.

-

The carrier argued it paid the executive the first installment of a $400,000 retention award in March 2020 and the second half in March 2021.