-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

Hippo will also provide capacity for existing and future MSI programs.

-

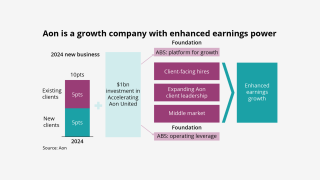

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

Howden recently expanded in South America with the takeover of Contacto and Innova Re.

-

The trend is expected to be most pronounced in the Middle East, the survey found.

-

The broker is targeting run-rate synergies of $150mn by the end of 2028.

-

The appointment follows B&B’s acquisition of Accession.

-

The deal multiple is understood to be around 15x adjusted Ebitda.

-

The $10bn acquisition of Risk Strategies is the biggest broker deal relative to size we have seen.

-

The acquirer will carry out a ~$4bn equity placement to help finance the transaction.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

White Mountains invested $150mn in the retail platform earlier this year.