-

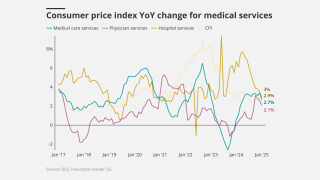

Inflation was down from the 3% recorded for the 12 months ending in September.

-

Louisiana Insurance Commissioner Tim Temple outlined key priorities for 2026 in an interview with Insurance Insider US.

-

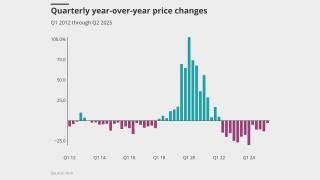

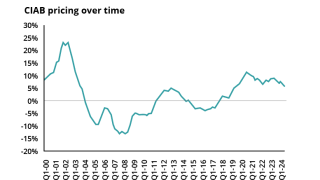

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

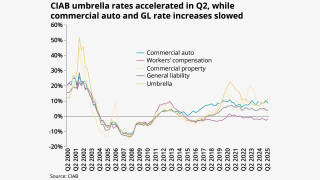

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

Texas was up over 25%, though California and Florida both recorded reductions.

-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

The subsegment is the latest commercial auto sector to feel the heat of litigation losses.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The carrier said it anticipates a better market due to recent reforms.

-

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Softening rates amid worsening loss costs paints an uncertain future for the industry.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the revision.

-

The broker said R&W rates rose to 2.8% in Q2 vs 2.5% in Q1.

-

The growth and profitability survey predicts 8.5% median growth for 2025.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

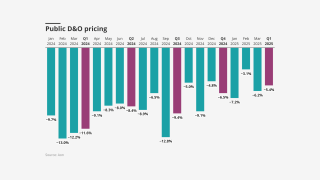

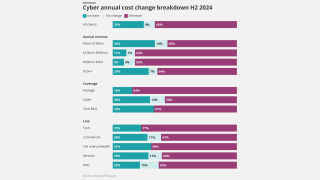

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The specialty carrier’s share price fell nearly 7% on the day of the call.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

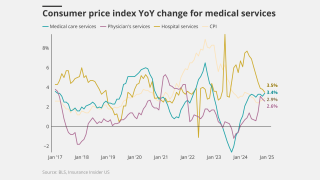

September’s medical care index increase follows a 0.2% drop in August.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

MGAs that are good operators will stick out compared to the rest.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

An average of 81% of property accounts renewed flat or down.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Growth concerns were top of mind at this year’s conference.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

Insurers continue to compete on price, especially in the SME sector.

-

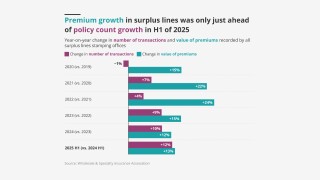

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

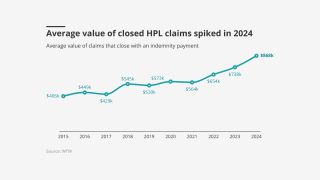

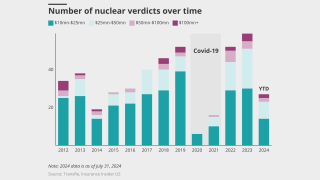

Juries don’t significantly differentiate in cases involving severe injury.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Rates continue to be favorable for buyers across major lines of coverage.

-

Global pricing is now 22% below the mid-2022 peak.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Growth in the SME sector could help stabilize the market, however.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

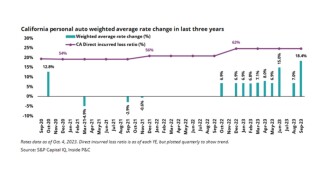

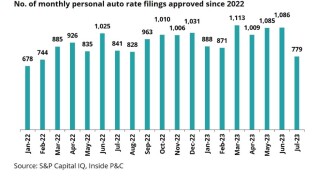

California, Florida and Texas all saw decreases in monthly premium growth.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

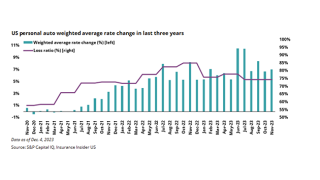

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

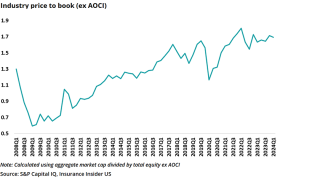

Last year marked the second consecutive year in which carriers made a positive return.

-

Capacity has gone up slightly, with new entrants and incumbents feeling better about their books.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

GL and workers’ comp, however, may benefit from a more competitive environment.

-

Ongoing pricing headwinds stand to weigh on carriers’ returns and valuations.

-

This is the first rate filing to use the recently approved Verisk model.

-

Commercial auto saw the largest rate change, which was down about a half point by the end of July to 7.96%.

-

July’s medical care increase was up from June’s o.6%.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

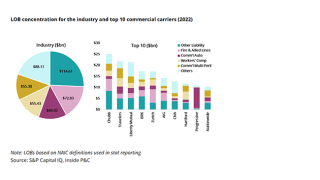

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

The risk of cyber incidents that cause physical damage is also rising.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The pace of increases ticked down in the second quarter compared to Q1.

-

The company adjusts its rate options to expand California business under the new cat model.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

Renewal rates fell, despite elevated catastrophe losses.

-

The company also encouraged insurers and brokers to support the initiative.

-

All lines except workers’ comp are up year over year, however.

-

Rate gains are easing across many commercial and personal lines.

-

June’s increase was up from May’s 0.2%.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Elevated cat losses in H1 weren’t enough to stop a further softening of the market.

-

Florida recorded premium growth in June after declines in May and April.

-

The soft market continued through H1 2025, especially on shared programs.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

Premium rose across the top 15 P&C risks in 2024.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The impact of SAM claims is reverberating through the tower and the broader marketplace beyond hospitals.

-

Coverage has broadened while limits have increased, the broker said.

-

The medical care index numbers were below April’s 0.5% rise.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

Insurers have termed the Democrat-backed legislation “flawed”.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

Companies often purchase policies with limits far exceeding their actual exposure needs.

-

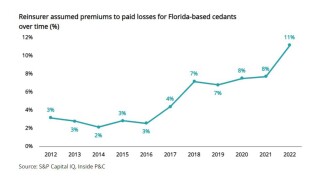

A 20% increase in FHCF retention levels sent cedants to the private market.

-

The collective CoR of 45 Floridians hit 93.1% in 2024

-

Rate cuts are slowing as insurers agonize over claims trends, but capacity is high.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

Lloyd’s traditionally avoided US middle market property, but head of P&C Matt Keeping says times have changed.

-

Third-party litigation financing remains the thorn in the sides of casualty insurers.

-

Competition and ample capacity are pushing premiums lower.

-

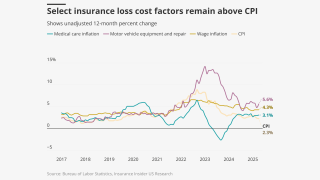

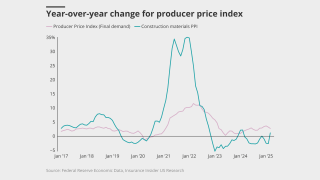

Inflation indices fell in April, but some items related to P&C are still elevated.

-

Most sectors saw lower premium increases, with five reporting decreases.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

The result has been a sharp increase in the use of captives.

-

The medical CPI is up 3.1% for the last 12 months.

-

Growth in construction projects is increasing the need for coverage.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

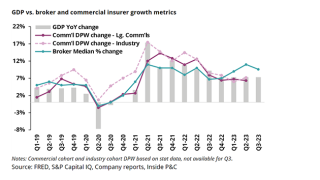

Median organic growth decelerated to 7.9% in Q1 from 9% in Q4 and 8.4% a year ago.

-

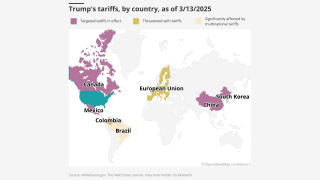

The conference came at a particularly tumultuous time for the US insurance industry and the economy at large.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

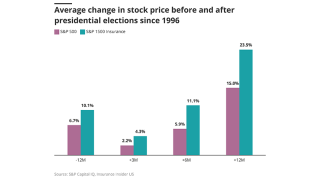

Inflection sets in for insurance stocks as macro albatross gets heavier.

-

The broker said the burgeoning class of business was still finding its stride.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

Macroeconomic volatility could also create top-line headwinds.

-

The only major product line to see rate increases was casualty.

-

Rates for umbrella accelerated to 9.26%, from 8.76% in Q4 2024.

-

California wildfires had ‘little or no impact’ on property cat pricing at April 1, Dean Klisura said.

-

After seven years of premium rate growth, rates are down 5% to 40% across the US.

-

The release followed the filing of an updated Plan of Operation.

-

Despite positive inflation headlines, there are issues for insurers under the surface.

-

Technical pricing is insufficient in some areas and inflation is biting into margins.

-

The medical CPI is up 3% for the last 12 months.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

Even if M&A activity picks up, Atlantic does not expect R&W rates to jump significantly.

-

The costs of accident/casualty-related claims continue to rise.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

The rating allows IQUW to access $1bn in group capital.

-

Last month’s inflation figures were lower than expected, but tariffs continue to loom.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

Four cat modelers have also submitted their tech for regulatory review.

-

Excess/umbrella liability and commercial auto broke the trend with high price increases, however.

-

Commercial auto was the exception, ticking up slightly from January.

-

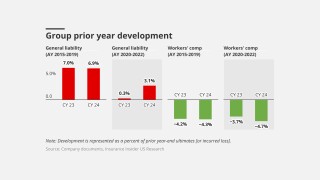

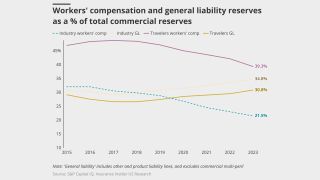

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

GL and commercial auto rates accelerate at year-end as social inflation worsens.

-

Insureds, however, are often reinvesting savings into purchasing increased limit.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

January CPI/PPI heats up but won’t translate to higher loss costs.

-

The insurance commissioner said the carrier has not shown the need for price increases.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

Guy Carp CEO Dean Klisura said LA wildfires could slow rate reductions at 1 April.

-

Changes in cat activity and social inflation have impacted carriers focused on the mid- and small commercial market.

-

The impact of the devastating California wildfires is too early to ascertain, executives said during earnings calls.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

Insurers are increasingly trying to push attachment points for excess layers up to $10mn.

-

Commercial auto ended the year with its biggest gains at 9.82%, compared to 9.71% in Q3 2024.

-

Loss-cost indicators are high for liability, low for property.

-

Rate increases averaged 0.0% in December 2024, from 16.3% in December 2023.

-

The all-items index posted a 2.9% rise for the last 12 months.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

CEO Trevor Carvey said the revision reflected Conduit’s “favourable reception”.

-

More competitive pricing is predicted for the commercial insurance market.

-

Third-party liability, auto, medmal and premises liability remain challenging.

-

CMP and BOP reached their highest levels in over a decade.

-

The all-items index rose 2.7% for the last 12 months.

-

The 2025 State of the Market report also touched on E&S and MGA growth.

-

The decision reflects CNA’s “consistently positive” operating performance.

-

Commercial property and workers' comp were down, while GL was flat.

-

The group posted a 15.1% gain for October and 27.4% for September.

-

Umbrella recorded the highest premium increase, at 8.6%.

-

The all-items index is up 2.6% for the last 12 months.

-

Earnings call commentary shows pockets of casualty reserve strengthening for AY 2020-2023.

-

Rates fell across all premium lines, especially for property and GL.

-

Excess casualty rates were up 10% and have been double-digit all year, the executive said.

-

The average for October was roughly half of that for September.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Greenberg said London behavior in cat market “is almost aberrant relative to everybody else”.

-

Total insured losses are expected to range from $34bn to $54bn.

-

The price for policies with the same limit and deductible decreased 6.0%.

-

However, rate gains again accelerated year over year for all lines except workers compensation.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

Sources said that Milton may slow the pace of rate deceleration.

-

This could change if Milton losses turn “ugly”.

-

CEO John Doyle said global property rates were down 2% versus flat in Q2.

-

Current rates at 2% to 2.5% translate to an 86% incurred loss ratio.

-

Deal flow is still far below levels seen in 2021.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

The all-items CPI increased 2.4% over the last 12 months.

-

The looming collapse of the city’s biggest livery insurer may not be cause for national concern.

-

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

D&O direct written premiums fell 8% YoY as of June 30, and direct earned premiums declined 16%.

-

While Republicans are typically perceived as best for business, there are several factors at play.

-

In Q2, median property price increases decelerated to 2.3%.

-

The all-items CPI increased 2.5% over the last 12 months.

-

Commercial auto and excess umbrella continue to face upward pressure.

-

Expansion of the middle-market book is an ongoing focus.

-

Rate increases on primary liability placements range from 10% to 20%.

-

The rate change will be implemented in November.

-

The report flagged “opportunistic underwriting” by many of the major markets.

-

Premiums increased 5.6% across all major lines, down from last quarter.

-

The all-items CPI increased 2.9% over the last 12 months.

-

The action follows the completed acquisition of Accredited by Onex Partners.

-

The measures include stricter timelines for rate application approvals and follow-ups.

-

The board of directors has voted for a 10% rate hike.

-

Workers' compensation rates fell again on a year-over-year basis.

-

Commercial liability and commercial property continue to dominate.

-

-

The top three states averaged a 14% YoY gain, compared to June’s 3.3%.

-

As property momentum slows, personal lines excess and surplus could start outperforming.

-

In messaging to the market, the cyber insurer described the rating environment as “stable and sustainable”.

-

The broker said achieving profitability “remains challenging” for insurers.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

Q2 was the ninth consecutive quarter of year-over-year price decreases.

-

The contraction so far this year is in line with the executive’s expectations.

-

On the contrary, GL rate changes decelerated sequentially to 4.9% from 5.9%.

-

Executives flagged elevated packaged auto loss activity in Q2.

-

Underwriters are getting increasingly granular, rewarding mitigation and prevention with better terms.

-

-

Average rate increases went to 5.6% in June 2024 from 28.2% in June 2023 .

-

Twia’s analysis showed existing rates were inadequate.

-

The insurance sector’s RoE is expected to exceed 10% next year.

-

Accounts with poor performance records are expected to see flat to 20% rate increases for cat coverage, according to Floridian broker Brown & Brown’s Q3 Market Trends report.

-

Stable first half insufficient to counterbalance concerns on reserving trends.

-

Worsening claims activity, privacy concerns and emerging threat actors have yet to reflect in pricing.

-

The flattish outcome comes after a larger year-on-year hike in January.

-

Reinsurers were more willing to support lower layers ahead of July 1, the broker said.

-

Challenges such as climate change and civil litigation remain troubling.

-

Workers’ compensation renewal rates decreased on a year-over-year basis.

-

In 2023, the segment had its best direct loss ratio in nearly a decade at 50.8%.

-

In high-capacity, global E&S property, London has continued to be aggressive.

-

The proposal now goes to the Florida Office of Insurance Regulation for review.

-

Commercial and residential carriers have different requirements.

-

Quarterly price increases of around 6% have remained steady since the pandemic.

-

The ratings agency noted robust profit margins for reinsurers.

-

The broad themes remained the same as those dominating in April.

-

Additional capacity for upper layer coverage is driving rate reductions, the broker says.

-

The decrease takes effect August 20, 2024, and impacts new and renewal business.

-

Ten companies have filed a 0% increase and at least eight companies have filed a rate decrease to take effect in 2024.

-

Average premiums rose 5.8% across all major lines, roughly flat from 5.7% in Q4.

-

YoY Ebitda margins for private brokers declined two points, to 29% in Q1.

-

An overview of Q1 earnings shows upsides, but also plenty of concerns going into the rest of 2024.

-

Only umbrella posted a higher rate increase, while workers’ comp continued to drop.

-

Reserving actions have added pressure to upward pricing.

-

As the industry gathers in San Diego, these are the key discussion points.

-

From here on out, insurers will likely have to rely on the strength of their individual stories.

-

Prices for programs that renewed in both Q1 2023 and Q1 2024 decreased 15%.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

Concern about vague cat modeling language was a theme at a Tuesday workshop.

-

The casualty segment posted $18mn of favorable reserve development across multiple accident years.

-

Property rate increases decelerated to 3% in the quarter.

-

A litany of underwriting and quoting constraints has made it much harder to write business.

-

For workers’ comp, premium renewal rates were down -0.88% compared to -0.64% for Q4.

-

Compared to March, more sources shared accounts of rate declines and oversubscription.

-

Ten states joined in the original suit.

-

Social inflation is driving “cat-type” losses, with an increase in $50mn-plus verdicts.

-

Retentions and coverage could be affected by future adverse claims trends.

-

Given ample capacity and no sharp increase in demand, a market sea change is not expected, barring an unforeseen economic event.

-

WTW said adverse development “is evident” in auto liability lines from 2015 to present.

-

Premium inflation holds, as loss-cost inflation trends continue to moderate.

-

This continues a consecutive quarterly gain of over 6%.

-

Personal lines rate filings are rising, even as some inflation drivers slow.

-

Commercial property rates for February rose 10.77%, up from 10.30% in January.

-

Premiums rose an average of 7% across all lines, down from Q3.

-

Carriers expressed confidence on the line’s ability to withstand medical inflation.

-

Otis could be a $2bn-$3bn loss, but more information is expected before June renewals.

-

CSAA writes over 70% of its business in the Golden State.

-

This follows a record-breaking $63bn of premium and 24.1% growth for 2022.

-

The carrier expects to "get smaller in New Jersey" due to lack of rate adequacy.

-

The broker said softening was emerging in some lines, but cat risks remain challenging.

-

The index’s 2023 peak was Q2, when rates increased 19%.

-

The growth positives of last year are showing signs of fading.

-

Falling rates in finpro and increased competition in property drove the trend.

-

Commercial property pricing rose 11%, while personal auto grew 21.9%.

-

Broker earnings reflect shifting tailwinds, with margins revealing the real winners.

-

The drivers are not surprising, but the extent of development is, execs said.

-

Property rate increases decelerated to 6% in Q4, compared to 7% in Q3 and 10% in Q2 2023.

-

Rates are generally cheaper than the admitted market.

-

The average 2023 premium renewal rate change for commercial property was significantly higher than 2022 across all months.

-

The broker’s Q4 programs reinsurance change led to a one-time $19mn charge that will allow it to reduce its PML exposure.

-

Organic growth will slow from historically elevated levels and the increased cost of debt will take its toll.

-

The brokerage reported that polled carriers, however, have pointed to ransomware activity reverting to 2019 levels to argue current pricing is unsustainable.

-

A “return to minimal valuation increases can be expected soon”, the broker wrote in its 2024 P&C market outlook report.

-

European rates on line increased by 7.60%, while in the US prices were up 5.25%.

-

2024 is likely to be another challenging year for the industry, and commercial in particular, though improvement in personal lines may soften the blow.

-

The broker said over-placement on some deals was a positive sign for brokers, though reinsurance capacity is still very tight in some areas.

-

Reinsurers are making some adjustments to secure target signings but appetite to grow is finely balanced.

-

Carriers aren’t calling off their retreat from the market until tangible, actionable regulations emerge from commissioner Lara’s camp, sources told this publication.

-

The need to recognize adverse development in the back book is the most plausible culprit for market behavior, and an escalation of rhetoric.

-

Cooling CPI metrics and improving loss ratios indicate a positive shift for the personal auto industry, but results are not yet back to where they need to be.

-

The 2024 budget increases net operating expenses to $40.2mn, up from $35.2mn in the 2023 budget.

-

Anticipations of a tug-of-war around a ‘flat to slightly up’ pricing renewal have indeed come to fruition.

-

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

The executive expects the carrier to write “a bit more” property cat business in the coming renewals as it manages the exposure of its entire book.

-

Of the major commercial lines of business tracked by Ivans, all experienced increases in premium renewal rate changes except commercial property and general liability.

-

The state is already experiencing affordability challenges, and regulators are concerned that an availability crisis is brewing.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Issues over reinsurance pricing and capacity continued to plague commercial property.

-

Profits are expected to widen thanks to improved rates and higher average attachment points.

-

Insurers should reserve as conservatively as possible, maximize their product set, and decide if they are buyers or sellers.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Meanwhile, the company’s October cat losses came in below the reporting threshold of $150mn, compared eith $317mn of cat losses in September and nearly $1.2bn for Q3.

-

Slowing loss cost trends may signal relief ahead, but only if carriers remain vigilant on rate action until we are past the peak.

-

The ratings agency said the change reflected its expectation that the carrier would post improving underwriting results in the next two years.

-

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Cedants and brokers are navigating the complexities of varying risk appetites signaled by reinsurers, who are willing to provide more capacity for cat treaty but only at certain layers as they maintain discipline.

-

Compared to September, all major commercial lines of business tracked by Ivans experienced increases in premium renewal rate changes.

-

The decline marked the sixth consecutive quarter of double-digit pricing declines.

-

TWIA has raised its net operating expenses to $40.2mn.

-

Commercial insurance pricing remained flat, increasing by 3% globally over the period, the same as the prior quarter.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

CNA continued to push for rate in lines of business affected by social inflation in Q3, as CEO Dino Robusto said the carrier was “pleased that there is an increasing awareness for this need in the marketplace”.

-

Chubb NA property soared 23% in Q3 with rates up 16.6% and exposure change of 5.5%, as casualty pricing rose 11%, with rates up 8.7% and exposure up 2%.

-

The revised status follows the recent announcement that R&Q Insurance Holdings has agreed a sale of its Accredited program.

-

“As we look to January 1, the market appears to be more orderly than last year, but we expect underwriting discipline to continue,” CEO John Doyle told analysts.

-

Data shows Texas developments parallel some of the trends in other troubled states, but it is heading in from a stronger position.

-

In 2022, Texas ranked third in incurred losses behind Florida and California, clocking in at $53bn, according to data from the Insurance Council of Texas.

-

Commercial property rates in Hawaii, which sustained a major wildfire event in August, went up to 5.02% that month from 1.65% in July, but remained lower than the average even after the increase.

-

Insurance regulators in California and other states signed off much-needed personal lines rate hikes in September.

-

Competing forces of loss cost inflation and mixed rate action yield uneven trajectories for the largest commercial lines.

-

The executive also recommitted Aon to its mission around creating net new markets – including growing IP – in the wake of the Vesttoo issues.

-

Nearly all lines showed “moderate to significant” price increases, except workers' compensation, D&O liability and cyber.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The carrier’s E&S property book is “up 29%, with 25 points of rate”, said the executive.

-

Floridians will bear the brunt of Idalia's losses as a retention event, but reinsurers will reap the benefits of pricing.

-

In contrast, cyber pricing continued slowing down as Q2 rates increased 3.6%, compared with 8.4% in Q1 and 15% in Q4 as the space was hit by increased competition.

-

Board members voted five to four in favor of rate increases but fell short of the two-thirds majority required.

-

In California, the carrier filed for a 35% increase this quarter after implementing a 6.9% rate hike in April.

-

It marked the highest YoY growth this year, followed by 46% growth in January and 40% in June.

-

At the same time, insurers are assessing the level needed to address loss cost trends.