-

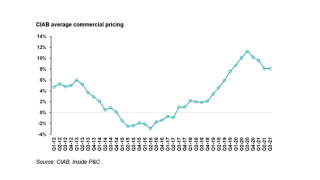

The protracted firming phase of the cycle continues, with E&S firmer than the admitted market.

-

The broker has reported successive slowdowns since price increases climbed to a peak in Q1 2020.

-

The insurer reported total P&C rate increases of 8% for the third straight quarter, down from the 13% gains in last year’s fourth quarter.

-

The company predicts a continued hard market across most lines for the year, with transportation, education, marine and cyber among those expected to rise the most.

-

The carrier is seeking to combat a return to pre-pandemic claims frequency and surging claims severity.

-

Cyber rates continue to spike globally, along with financial and professional lines, Marsh data shows.

-

Woodruff Sawyer noted that the SEC, Finra, and the DoJ are likely to continue focusing on the SPAC market in 2022.

-

For the SPAC market, sources said that prices should continue to harden, while D&O rates are expected to stabilize amid a capacity flush.

-

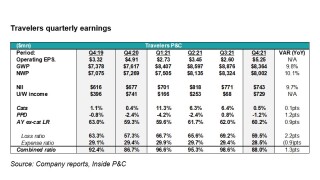

The firm reported encouraging quarterly earnings, but social inflation and other challenges still loom.

-

Although auto insurance rates dipped briefly, the average rate whipsawed 3% since 2020 and up 26% since 2011.

-

In December, SLTX reported nearly $830mn in surplus lines premium, representing a 15.3% year-on-year increase and marking the highest recorded December in the 33-year history of the non-profit Texan organization.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.