-

Strategic Review Committee chairman Bruce Simberg sets out the challenge ahead for FedNat as natural catastrophes continue to hit southern policyholders.

-

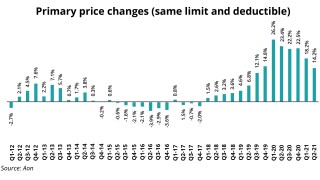

Price increases for high-hazard risks range between 15%-25%, down from +30% increases last year, while better performing classes are seeing 5%-10% rate increases.

-

“When you deploy property aggregate, the return you need on that is meaningful in light of the risk that you’re assuming,” Zaffino said Thursday. “I’m not sure if a plus mid-single digit [rate increase] gets you there in light of the [loss activity] we’re looking at.”

-

Texas’s objection to Progressive’s recent rate filings garnered attention, calling rates “excessive” and suggesting rebates instead.

-

Respondents said that cyber underwriters were responding to the growth of ransomware attacks and poor risk management.

-

July CPI data show first decline in auto premiums since December, but prices overall continue to rise.

-

Property, GL, umbrella, and BOP rates all accelerated, while workers’ compensation remained in negative territory.

-

Moody’s expects RMS, which had about $320mn in revenue around $55mn in operating income last year, to become accretive to earnings by 2025.

-

Horace Mann will adjust rates soon to deal with higher labor and materials costs.

-

From storms to Covid, large catastrophes are affecting P&C terms and limitations.

-

Adjusted for large renewals and IPOs, the pricing index rose 7.7% in the second quarter.

-

COO Brian Haney pushed back on the notion that rate hikes had hit their peak and said he expected rising inflation to "prolong the hard market".