-

In its marketplace realities report, the broker notes that D&O rate rises are beginning to tail off.

-

The pricing disclosures from both carriers indicated rate moderation for the first time in many quarters.

-

The Nasdaq-listed parent plans to list up to half of the unit in the third quarter.

-

The CEO says WR Berkley is benefitting also from a continued reduction in appetite by standard insurers.

-

The rate of softening in the workers' compensation market slowed in Q1, with pricing cuts averaging -1.37%.

-

The executive says the carrier made strides last year in its underwriting and is well positioned for growth.

-

The Aon president said insureds will begin to “test” carriers and brokers on price.

-

The survey finds rate rises were most pronounced for excess liability and D&O business.

-

The broker’s index suggests cyber rates surged ahead of January 1 renewals.

-

The broker says also that the Florida and south Florida condominium market has become micro-hard in recent weeks.

-

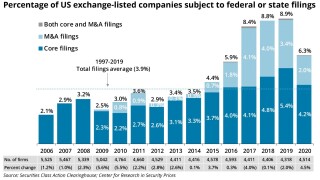

Rate rises in the D&O market held steady during the first two months of 2021, even as underwriting criteria for public D&O risks began to loosen in initial signs that the line may lose momentum during the second half of the year.

-

The personal and commercial lines book will be folded into recently-acquired Centauri Insurance.