-

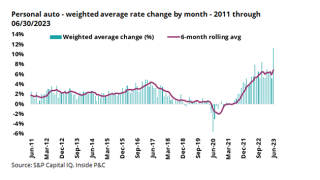

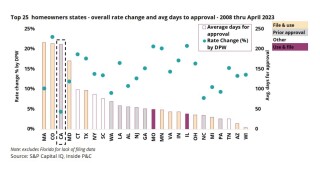

Rates continue to rise through June, with the homeowners’ weighted average rate change coming in at 8% for the month, while auto rates increased by a significant 11.3%.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

New homeowners' policies in wildfire-prone areas will have to flow to the non-admitted market or the state’s last resort, the California Fair Plan.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

CPI figures show loss costs are cooling, and if rate levels cannot reach adequacy we are likely to see more pausing from the industry beyond State Farm, Allstate and Nationwide.

-

The investigation enquires into how the US insurance industry evaluates, invests in or underwrites fossil fuel expansion projects.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

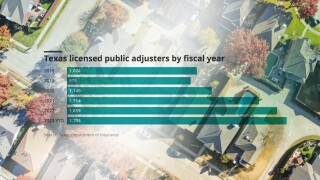

In the non-admitted property market, more policies are including language that discourages clients from hiring adjusters.

-

The bills place additional requirements on insurers in the state and expand consumer protections.

-

Continuing rises in loss frequency and severity plus a difficult regulatory framework make the situation in California highly challenging for carriers.