-

This was Ryan’s second-largest 2024 deal, after its $1.4bn Assure purchase.

-

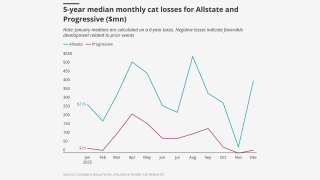

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

CEO Tim Turner said the firm still has an ambitious M&A pipeline and financial flexibility to execute deals.

-

Sources said that the MGA has been working with investment bank Waller Helms to find a potential investor.

-

Sources said California regulators need to show they’re receptive to private insurer needs.

-

The news comes around three months after GTCR agreed to sell AssuredPartners to AJ Gallagher for nearly $13.5bn.

-

The company stopped writing new business last September and lost capacity from SiriusPoint.

-

The ratings agency has revised Mercury’s outlook from stable to negative.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

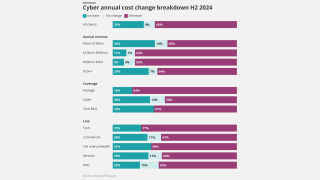

Insureds, however, are often reinvesting savings into purchasing increased limit.

-

The traditional R&W product is seeing an increasing number of large losses.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.