-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The losses do not change the near-term assessment of CinFin’s balance sheet strength.

-

The bill seeks prompt claims payments and settlements, and greater transparency.

-

The estimate covers property and vehicle claims.

-

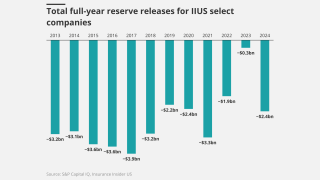

Casualty reserve concerns continue to mount as releases remain elevated.

-

The broker attributed the drop to smaller average deal sizes over the quarter.

-

His predecessor Peed remains with the firm as executive chairman.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

The company will ‘aggressively pursue subrogation’ for the Eaton Fire.

-

The supply chain in personal auto, and the impact on inflation are areas of concern.

-

Annual report pegged data and cyber security risks as most cited business challenges.

-

Insurers could absorb as much as 90% of this year’s already elevated losses given shifts in attachment points.