Travelers

-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

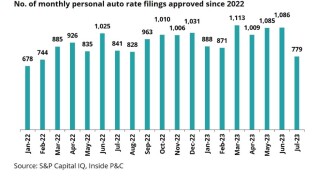

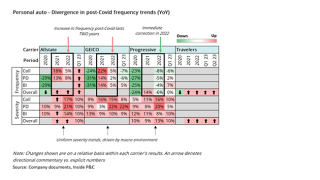

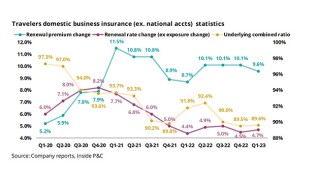

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

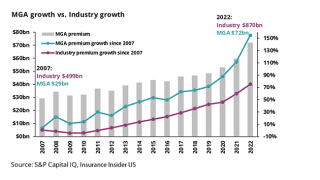

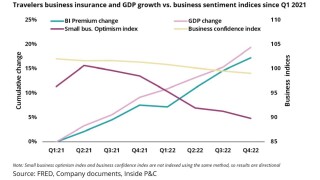

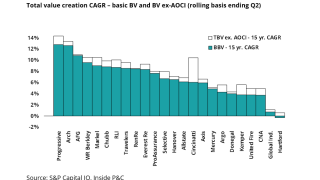

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Early Q3 earnings reports point to worsening market conditions.

-

The selloff may hint at headwinds for equity investors.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

The carrier reported favorable reserve development of $22mn compared to $126mn in Q3 last year.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

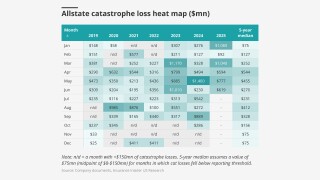

The research team presents the June cat heatmap.

-

Pricing slowdown and reserving concerns are the hot-button topics as earnings kick off.

-

On the rate environment, Schnitzer said the amplitude of the pricing cycle is shrinking.

-

Cat losses declined to $927mn from over $1.5bn a year ago on windstorms and hailstorms.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

Insurers haven’t announced concrete steps – yet.

-

The executive has been with the firm’s underwriting team for over 12 years.

-

A one-time impact would be a mid-single digit increase to physical injury auto severity.

-

The business insurance segment booked a CoR of 96.2%, up 2.9 points YoY.

-

The decision is the first of its kind under the new Trump administration.

-

Its post-tax estimate of $1.3bn is net of reinsurance recoveries.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Cat activity was a “modest” $175mn for Q4, but still up year over year.

-

The insurer also added $150mn cat coverage while reducing the total ceded premium for this treaty.

-

Cat losses rose to $175mn, fueled by Hurricane Milton and higher Helene estimated losses.

-

‘Emotionally driven’ claims by non-profits underscore their unique D&O exposures, according to Travelers' Nicole Murphy.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

A quick roundup of our best journalism for the week.

-

Newcomers enter on the belief that they have a “better mousetrap”, said Donato Monaco.

-

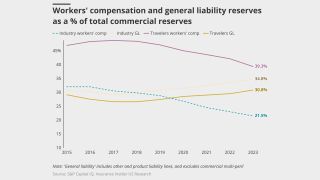

Asbestos claims for exposed insurers could place more pressure on workers’ comp reserves.

-

Umbrella and commercial auto led Q3 rate hikes with double-digit increases.

-

The firm reported $547mn from Hurricane Helene losses.

-

Top concerns also included medical cost inflation and employee benefit costs.

-

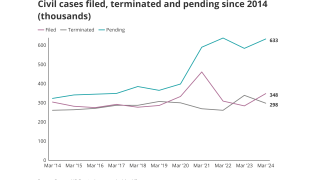

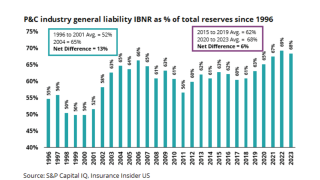

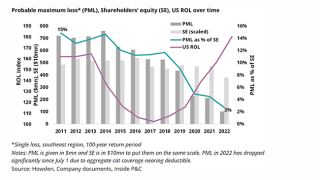

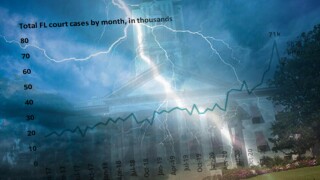

Civil case, nuclear verdict and claims count data show worrying trends.

-

The figure represents a quarterly increase of 102%.

-

Travelers now holds around 6.2% of Fidelis, down from over 7.2%.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

The report also noted that 35% of injuries occurred during an employee’s first year.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

A quick round-up of today’s need-to-know news, including the Microsoft outage and Travelers' results.

-

The carrier purchased an additional $150mn of cover.

-

The firm strengthened GL reserves by $250mn, for AY 2021-2023.

-

The carrier’s underlying combined ratio improved 3.4 points year on year to 87.7%.

-

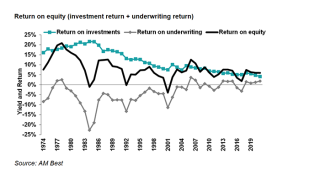

Changes in investment strategy and strong results show carriers can weather financial storms.

-

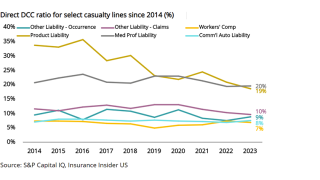

Downward trends of DCC ratios are beginning to reverse, which could cause issues for long-tailed lines.

-

Corrective actions revealed by Travelers in the first-quarter earnings could set the stage for similar moves from peers

-

The insurer is currently transitioning Corvus' ‘profitable’ $200mn book of business.

-

Underlying improvement was driven by a decrease in the personal lines core CoR.

-

SEC filings show that Travelers’ equity ownership was valued at over $107mn in Q4.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

The percentage of cases that could lead to higher losses increased in 2023.

-

Shares rose to over $213 at one point – from their previous close of $198.35 – after this morning’s Q4 results, which included an 8.7 point combined ratio (CoR) improvement driven by a rebound in personal lines.

-

The carrier also renewed the 20% quota share with Fidelis, maintaining the same loss ratio cap the parties agreed in 2023.

-

The program’s retention remained the same at $3.5bn.

-

The personal insurance segment’s CoR slashed to 86.8% from 105.3% in the prior year quarter, as the contribution of cat losses declined by 7.3 points to 2%.

-

The announcement closes the $435mn-deal which was announced in early November.

-

Travelers is set to expand its core cat treaty by between $1bn and $1.5bn, in a further sign of increased demand for cat reinsurance coverage at 1 January, this publication can reveal.

-

Sources agree that there are others that could follow a similar playbook, but there are three key considerations to keep in mind when pursuing a strategic-on-InsurTech transaction.

-

The Insurance Insider US Research team walks buyers through valuation considerations for InsurTech MGAs, as capital constraints point to further consolidation.

-

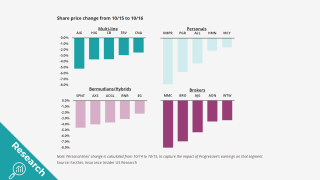

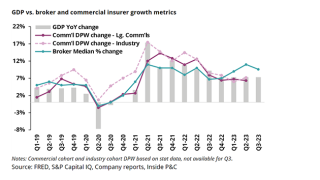

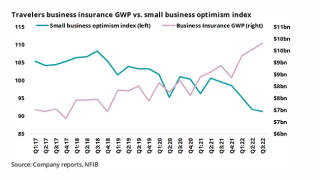

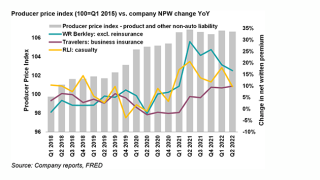

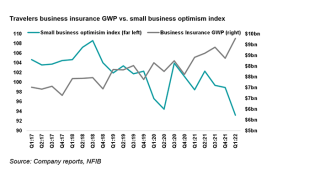

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

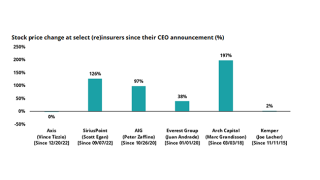

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

The transaction is expected to close in the first quarter of 2024, subject to regulatory approvals.

-

A clear commonality is already emerging much as it did in the previous quarter, when severe convective storms – particularly hail – also dominated.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

“In the next few weeks, the third chapter will begin and I am excited to engage with the new team. I can’t share the details just yet but will provide an update in the near future,” Joseph Meisinger announced.

-

The carrier booked net pre-tax unfavorable development of $154mn in Q3, primarily driven by $263mn of unfavorable development from its business insurance unit.

-

CFO Frey noted that there was “nothing terribly significant in this quarter” with regards to the company’s view of loss trends.

-

Catastrophe losses of $850mn were primarily the result of “numerous” severe wind and hail storms in multiple states, the company said.

-

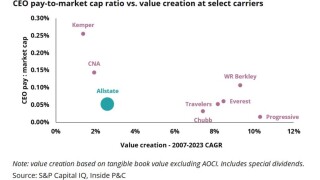

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

The survey found that a majority of Canadian businesses consider cyber threats their top concern and also believe they will eventually fall victim to a cyberattack.

-

According to a source familiar with the matter, policyholders will see four changes coming – some nationwide and others specific to certain states.

-

At the same time, insurers are assessing the level needed to address loss cost trends.

-

Q2 cat losses reported by most carriers were significantly higher than a year ago owing to the number of US convective storms and likely higher carrier retentions at reinsurance renewals.

-

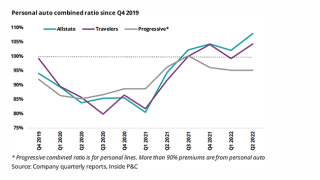

Progressive has now reported three consecutive months of adverse development. The Inside P&C Research team takes a closer look.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

After the $1.5bn cat loss, CFO Dan Frey said Q2 was the second largest ever cat amount the insurer has seen for a second quarter with six events over the $100mn mark.

-

The insurer also added $100mn to its northeast cat treaty as it posted $1.48bn of cat losses in the second quarter.

-

The insurer’s personal lines business booked over $1bn of cat losses with a $979mn impact on the homeowners' segment, up from $473mn in Q2 2022.

-

Travelers posts strong results boosted by better pricing, personal lines performance, and favorable development.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

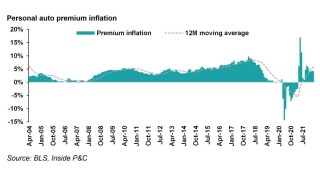

The firm expects to raise personal auto rates further after a 4.6-point deterioration in its Q1 core CoR due to increased vehicle replacement, repair costs and higher severity.

-

The increased catastrophe losses were driven by severe wind and hailstorms in multiple states.

-

Based in Atlanta, Duncan will report to Travelers EVP and president of small commercial and business insurance business centers Eric Nordquist.

-

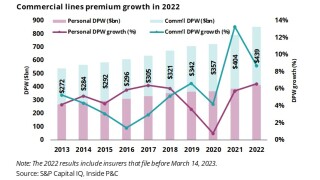

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The firm’s flattening rates and favorable reserve development provide a read-through for commercial insurers.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company's portion of net written premiums from Fidelis is expected to be around $550mn to $600mn for the full year.

-

While performance in commercial lines was “exceptional”, personal lines suffered.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier expects to report core income of $810mn, or $3.40 per diluted share, for the quarter - missing analyst consensus.

-

The MGA will write the cyber business out of its recently opened Frankfurt office.

-

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

Discussion on Q3 earnings calls focused heavily on the supply-demand imbalance in cat capacity, as executives discussed how they would navigate a challenging January renewal.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The two specialty insurers reported strong Q3 2022 earnings, continuing to outperform the commercial industry in underwriting gains and value creation.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm reported better than anticipated earnings factoring in Ian, but a slowing economy could cloud the outlook.

-

Executives said that current estimates for Hurricane Ian losses are favorable relative to Travelers' corresponding market share.

-

The firm booked a Q3 reserve charge at its business insurance unit driven by $212mn asbestos-related losses.

-

A challenging legal atmosphere and drift in loss cost components add difficulty to the task of tallying ultimate losses.

-

Cyber threats were the top overall concern for business decision-makers (59%) ahead of broad economic uncertainty (57%) and fluctuations in oil and energy costs (56%).

-

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

The executive rejoined Travelers excess casualty unit over two years ago after almost four years at Aon, where he was account executive.

-

Chubb pushed its loss trend assumptions higher as it seeks to stay ahead of inflationary pressures.

-

The insurer’s results are in line with other carriers, but they are ahead of the curve on adjusting loss costs.

-

Commercial insurers surprised with continued positive results despite economic conditions.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

For domestic automobile, renewal premium change was 6.3%, up a full three points from the first quarter of 2022 and the carrier expects the increases to continue.

-

The uptick runs counter to recent commentary on a slow drift down in rates.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

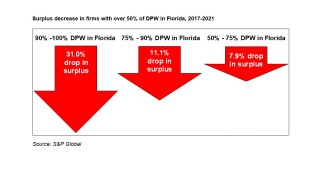

Excessive litigation costs and continued losses threaten the Sunshine state’s market.

-

Shareholders also narrowly voted against a proposal relating to a third-party racial equity audit.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

Inside P&C’s news team runs you through the key developments from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The commercial lines bellwether reported positive quarterly earnings, but challenges may still be ahead.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm took $175mn of qualifying losses as cat claims dropped notably from last year’s Uri-impacted quarter.

-

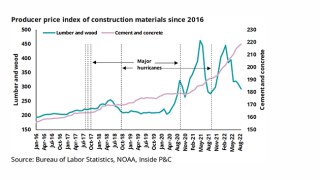

Management remained cautious about the loss cost environment during the company’s Q1 2022 earnings call as the Ukraine-Russia conflict rages on top of domestic exposures.

-

The underlying combined ratio in its personal lines segment increased by 7 points as the supply chain crisis bites.

-

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

Following the acquisitions of Trov and Insureon, what InsurTech M&A deals are next?