Travelers

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Early Q3 earnings reports point to worsening market conditions.

-

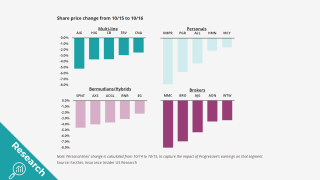

The selloff may hint at headwinds for equity investors.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

The carrier reported favorable reserve development of $22mn compared to $126mn in Q3 last year.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

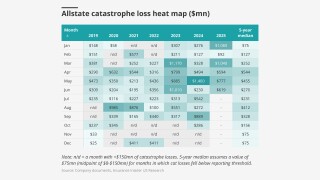

The research team presents the June cat heatmap.

-

Pricing slowdown and reserving concerns are the hot-button topics as earnings kick off.

-

On the rate environment, Schnitzer said the amplitude of the pricing cycle is shrinking.

-

Cat losses declined to $927mn from over $1.5bn a year ago on windstorms and hailstorms.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

Insurers haven’t announced concrete steps – yet.

-

The executive has been with the firm’s underwriting team for over 12 years.

-

A one-time impact would be a mid-single digit increase to physical injury auto severity.

-

The business insurance segment booked a CoR of 96.2%, up 2.9 points YoY.

-

The decision is the first of its kind under the new Trump administration.

-

Its post-tax estimate of $1.3bn is net of reinsurance recoveries.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Cat activity was a “modest” $175mn for Q4, but still up year over year.

-

The insurer also added $150mn cat coverage while reducing the total ceded premium for this treaty.

-

Cat losses rose to $175mn, fueled by Hurricane Milton and higher Helene estimated losses.

-

‘Emotionally driven’ claims by non-profits underscore their unique D&O exposures, according to Travelers' Nicole Murphy.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

A quick roundup of our best journalism for the week.

-

Newcomers enter on the belief that they have a “better mousetrap”, said Donato Monaco.

-

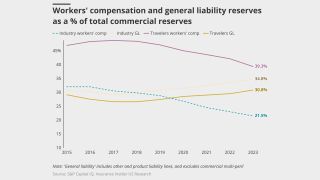

Asbestos claims for exposed insurers could place more pressure on workers’ comp reserves.

-

Umbrella and commercial auto led Q3 rate hikes with double-digit increases.