Travelers

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

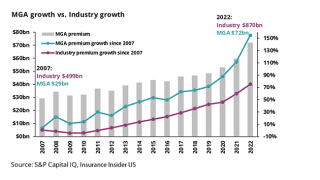

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Early Q3 earnings reports point to worsening market conditions.

-

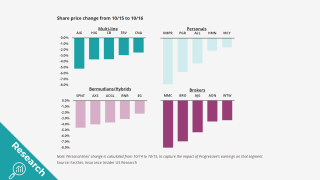

The selloff may hint at headwinds for equity investors.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

The carrier reported favorable reserve development of $22mn compared to $126mn in Q3 last year.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

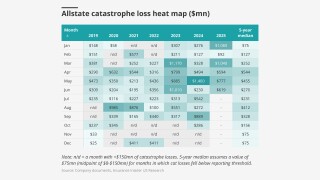

The research team presents the June cat heatmap.

-

Pricing slowdown and reserving concerns are the hot-button topics as earnings kick off.

-

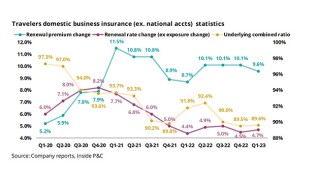

On the rate environment, Schnitzer said the amplitude of the pricing cycle is shrinking.

-

Cat losses declined to $927mn from over $1.5bn a year ago on windstorms and hailstorms.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

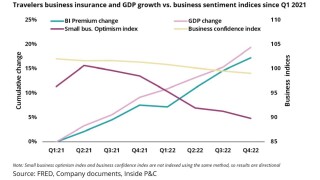

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

Insurers haven’t announced concrete steps – yet.

-

The executive has been with the firm’s underwriting team for over 12 years.

-

A one-time impact would be a mid-single digit increase to physical injury auto severity.

-

The business insurance segment booked a CoR of 96.2%, up 2.9 points YoY.

-

The decision is the first of its kind under the new Trump administration.

-

Its post-tax estimate of $1.3bn is net of reinsurance recoveries.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Cat activity was a “modest” $175mn for Q4, but still up year over year.

-

The insurer also added $150mn cat coverage while reducing the total ceded premium for this treaty.

-

Cat losses rose to $175mn, fueled by Hurricane Milton and higher Helene estimated losses.

-

‘Emotionally driven’ claims by non-profits underscore their unique D&O exposures, according to Travelers' Nicole Murphy.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

A quick roundup of our best journalism for the week.

-

Newcomers enter on the belief that they have a “better mousetrap”, said Donato Monaco.

-

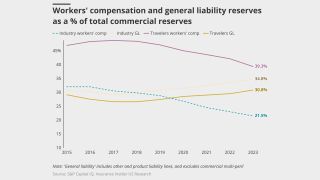

Asbestos claims for exposed insurers could place more pressure on workers’ comp reserves.

-

Umbrella and commercial auto led Q3 rate hikes with double-digit increases.

-

The firm reported $547mn from Hurricane Helene losses.

-

Top concerns also included medical cost inflation and employee benefit costs.

-

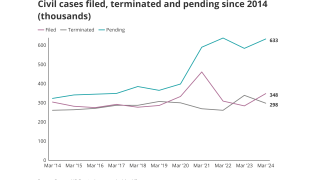

Civil case, nuclear verdict and claims count data show worrying trends.

-

The figure represents a quarterly increase of 102%.

-

Travelers now holds around 6.2% of Fidelis, down from over 7.2%.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

The report also noted that 35% of injuries occurred during an employee’s first year.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

A quick round-up of today’s need-to-know news, including the Microsoft outage and Travelers' results.

-

The carrier purchased an additional $150mn of cover.

-

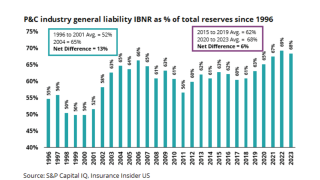

The firm strengthened GL reserves by $250mn, for AY 2021-2023.

-

The carrier’s underlying combined ratio improved 3.4 points year on year to 87.7%.

-

Changes in investment strategy and strong results show carriers can weather financial storms.

-

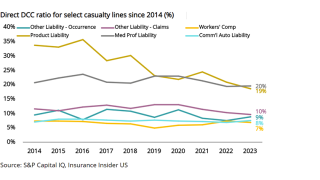

Downward trends of DCC ratios are beginning to reverse, which could cause issues for long-tailed lines.

-

Corrective actions revealed by Travelers in the first-quarter earnings could set the stage for similar moves from peers

-

The insurer is currently transitioning Corvus' ‘profitable’ $200mn book of business.

-

Underlying improvement was driven by a decrease in the personal lines core CoR.

-

SEC filings show that Travelers’ equity ownership was valued at over $107mn in Q4.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

The percentage of cases that could lead to higher losses increased in 2023.

-

Shares rose to over $213 at one point – from their previous close of $198.35 – after this morning’s Q4 results, which included an 8.7 point combined ratio (CoR) improvement driven by a rebound in personal lines.

-

The carrier also renewed the 20% quota share with Fidelis, maintaining the same loss ratio cap the parties agreed in 2023.

-

The program’s retention remained the same at $3.5bn.

-

The personal insurance segment’s CoR slashed to 86.8% from 105.3% in the prior year quarter, as the contribution of cat losses declined by 7.3 points to 2%.

-

The announcement closes the $435mn-deal which was announced in early November.

-

Travelers is set to expand its core cat treaty by between $1bn and $1.5bn, in a further sign of increased demand for cat reinsurance coverage at 1 January, this publication can reveal.

-

Sources agree that there are others that could follow a similar playbook, but there are three key considerations to keep in mind when pursuing a strategic-on-InsurTech transaction.

-

The Insurance Insider US Research team walks buyers through valuation considerations for InsurTech MGAs, as capital constraints point to further consolidation.

-

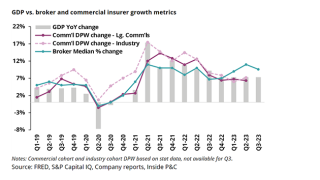

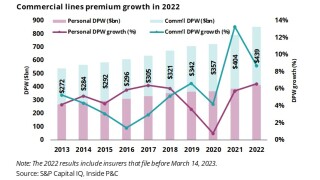

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

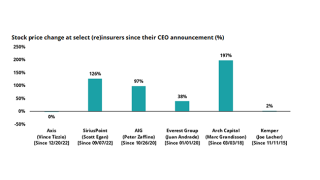

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

The transaction is expected to close in the first quarter of 2024, subject to regulatory approvals.

-

A clear commonality is already emerging much as it did in the previous quarter, when severe convective storms – particularly hail – also dominated.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

“In the next few weeks, the third chapter will begin and I am excited to engage with the new team. I can’t share the details just yet but will provide an update in the near future,” Joseph Meisinger announced.

-

The carrier booked net pre-tax unfavorable development of $154mn in Q3, primarily driven by $263mn of unfavorable development from its business insurance unit.

-

CFO Frey noted that there was “nothing terribly significant in this quarter” with regards to the company’s view of loss trends.

-

Catastrophe losses of $850mn were primarily the result of “numerous” severe wind and hail storms in multiple states, the company said.

-

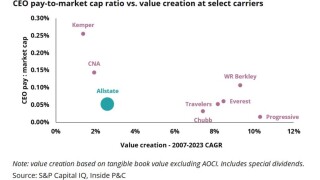

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

The survey found that a majority of Canadian businesses consider cyber threats their top concern and also believe they will eventually fall victim to a cyberattack.

-

According to a source familiar with the matter, policyholders will see four changes coming – some nationwide and others specific to certain states.

-

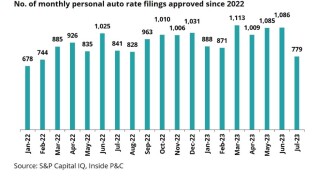

At the same time, insurers are assessing the level needed to address loss cost trends.

-

Q2 cat losses reported by most carriers were significantly higher than a year ago owing to the number of US convective storms and likely higher carrier retentions at reinsurance renewals.

-

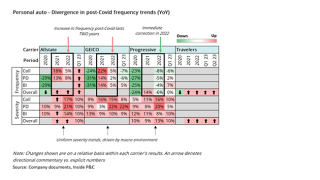

Progressive has now reported three consecutive months of adverse development. The Inside P&C Research team takes a closer look.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

After the $1.5bn cat loss, CFO Dan Frey said Q2 was the second largest ever cat amount the insurer has seen for a second quarter with six events over the $100mn mark.

-

The insurer also added $100mn to its northeast cat treaty as it posted $1.48bn of cat losses in the second quarter.

-

The insurer’s personal lines business booked over $1bn of cat losses with a $979mn impact on the homeowners' segment, up from $473mn in Q2 2022.

-

Travelers posts strong results boosted by better pricing, personal lines performance, and favorable development.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm expects to raise personal auto rates further after a 4.6-point deterioration in its Q1 core CoR due to increased vehicle replacement, repair costs and higher severity.

-

The increased catastrophe losses were driven by severe wind and hailstorms in multiple states.

-

Based in Atlanta, Duncan will report to Travelers EVP and president of small commercial and business insurance business centers Eric Nordquist.

-

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The firm’s flattening rates and favorable reserve development provide a read-through for commercial insurers.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company's portion of net written premiums from Fidelis is expected to be around $550mn to $600mn for the full year.

-

While performance in commercial lines was “exceptional”, personal lines suffered.