-

A district court judge had dismissed the case in September, with prejudice.

-

Several lines had price decreases, while growth in most sectors slowed from previous quarters.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

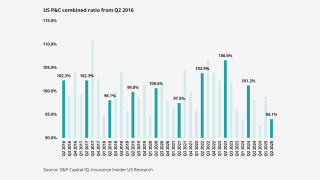

A favorable nine months for the industry does not solve its underlying problems.

-

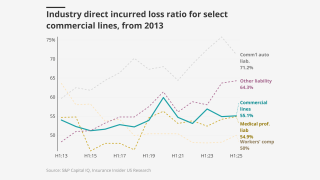

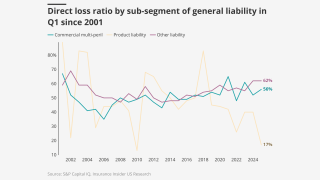

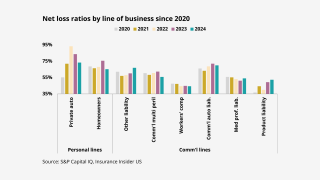

Loss ratios in troubled casualty lines ticked down year-over-year despite worsening loss costs.

-

The company has now posted rate increases for 37 consecutive quarters.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

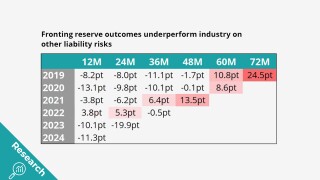

Fronting doesn’t look any better when it’s broken down by segment.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The WCB has denied the allegations, claiming its decisions were based on “reasonable investigations”.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

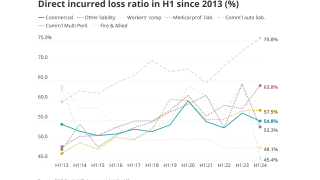

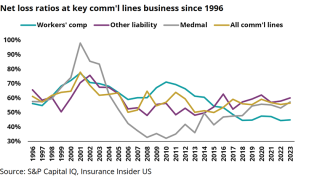

Persistent social inflation challenges evident across key long-tail lines at half-year mark.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

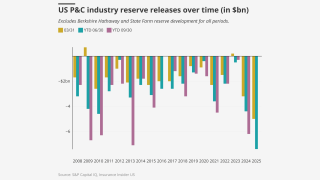

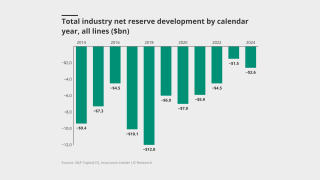

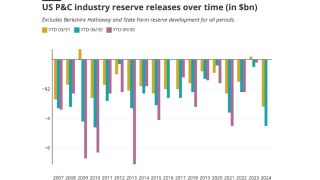

High H1 reserve releases of $7.4bn were driven by the largest of carriers.

-

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

Equidad earlier sold its soccer team to group of US investors that includes actor Ryan Reynolds.

-

GL and workers’ comp, however, may benefit from a more competitive environment.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

The alleged insurance fraud targeted anyone who could fund the settlements, argued the plaintiffs.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The rules would require paid rest breaks, among other measures.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Sources said that the program manager is being advised by Dowling Hales.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

Macroeconomic volatility could also create top-line headwinds.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

The executive will also oversee premium audit and customer service.

-

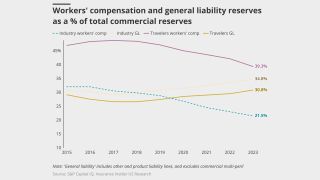

What past trends can tell us about the future of commercial reserving.

-

Defendants claim that Tradesman lacks standing to bring the case.

-

The InsurTech was also removed from under review, negative.

-

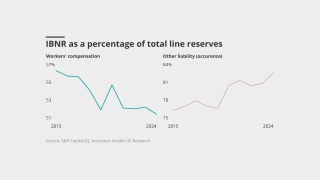

Newly released annual stat filings on reserve data show some troubling trends.

-

The industry continues to take reserve addition medicine in smaller doses than recommended.

-

Executives see earnings benefits from workers’ comp beginning to diminish.

-

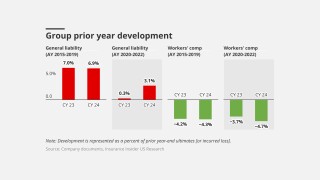

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

Profitability over growth continues to be the company’s “mantra”.

-

The bill was introduced shortly after a similar bill failed in Mississippi.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

NCCI’s WCWMI posted 2.3% growth last year, below 2023’s 2.9%.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

Trends leading into 2025 may indicate workers’ comp releases have peaked.

-

Executives have said that the carrier’s conservative reinsurance program made losses sustainable.

-

The law takes effect January 1.

-

A jury found the retailer defamed a former driver with false claims of workers’ compensation fraud.

-

Through Q2 2024, the index is up 10% since 2020.

-

Executives said the company continues to shrink its book of business in markets with poor underwriting conditions.

-

Plaintiff Ionian has alleged a “fraudulent scheme” under the Rico laws.

-

Asbestos claims for exposed insurers could place more pressure on workers’ comp reserves.

-

Despite pricing declines, state funds recorded their third year of DWP growth.

-

Increasing loss picks in difficult lines suggest top writers are accepting shifting loss trends.

-

The lawsuit names additional attorneys, doctors and medical practices.

-

Umbrella was the exception, ticking up slightly on the month.

-

The highest releases in nearly 15 years challenge conventional wisdom on reserving.

-

States are grappling with first responder claims litigation as some move to expand presumptions to more worker types.

-

The complaints are the first effort to crack down on existing suspicions.

-

The report also noted that 35% of injuries occurred during an employee’s first year.

-

The executive said the company remains optimistic about small commercial, where NWP grew 8.5% in Q2.

-

Reserve analysis shows that OL reserving may be insufficient for recent AYs.

-

Rising medical inflation, less favorable frequency trends and difficulty in getting rate are challenging the line.

-

The first RICO complaint targeted medical providers and training centers.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

Reserve releases in workers' comp may have been premature despite industry confidence.

-

Hansen joined the California-based workers’ compensation provider in 2006.

-

The H2 rate predictions mark a slight moderation from those in H1.