-

As we stand today, the InsurTech consolidation prophecy has not come to pass, even after a period of tanked valuations and dwindled access to capital.

-

If January’s trends are any indication, the next step for Florida’s plaintiff attorneys will be to redirect their efforts to another piece of the market.

-

A canvass of Florida executives by Inside P&C suggests glimmers of an improved claims environment ahead.

-

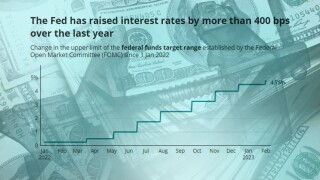

Increased cost of capital is cooling tuck-in M&A, encouraging a pivot to organic growth and forcing greater creativity around financing.

-

The proposed change could disrupt M&A at brokers, shift the calculus in favor of team lifts and dial up C-suite focus on becoming an employer of choice.

-

The firm’s strategy to consolidate trading relationships faces fundamental, cyclical and company-specific challenges.

-

Larger, better performing, more diversified and more E&S-heavy insurers will be better able to prosper in a more volatile environment.

-

Long-term, structural challenges in the class have now been laid bare following the contraction in the treaty market.

-

The bank is running a process to seek a minority stake sale of its broking arm, and is in talks with Stone Point and CD&R.

-

2022 marked a reversal from last year’s unprecedented levels of global investment in InsurTech as the macroeconomic scenario flipped and investors put lossmaking companies under a magnifying glass.

-

Several structural factors, including the pricing cycle, make insurers more insulated from US activist states.

-

Consistent underwriting performance, the completion of the exit from life, acquisitions, organic growth and succession planning will all be focuses.