Progressive

-

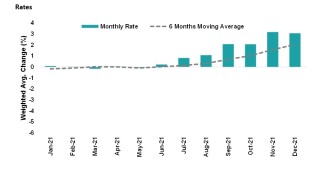

Progressive’s response has been to take underwriting and non-underwriting actions and work with regulators to take more rate.

-

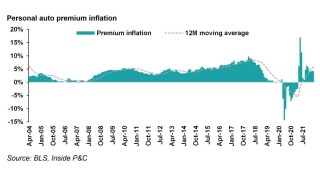

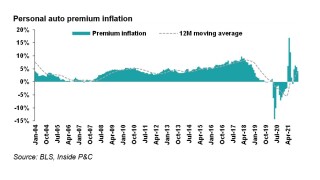

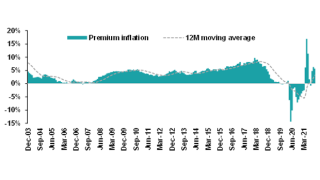

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

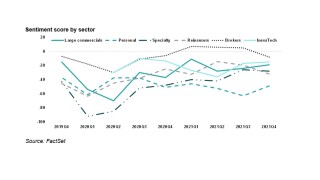

Insurance carriers tailor their comments to leave investors walking away with an optimistic view.

-

While vehicle miles traveled dipped in January, likely due to the Omicron variant, the auto insurer said February’s preliminary results indicate a rebound and frequency is expected to rise.

-

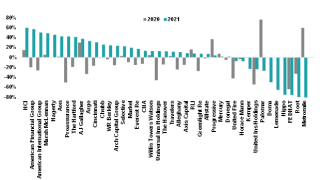

The insurer’s net premiums written in personal lines also increased by nearly $3bn to $36.2bn for 2021.

-

The latest report shows even higher inflation pushing up severity, forcing carriers to take rate.

-

Data from Apple and Google show that Omicron has slowed the return to driving in some of the largest states by premiums.

-

Johnson’s departure follows the deal in which auto firm Progressive Corporation acquired the Indiana-based insurer for $338mn.

-

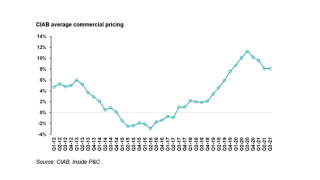

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Inside P&C dissects the biggest deals of the year across broking, commercial lines and InsurTech.

-

The monthly CPI report shows that inflation continues to push severity higher as carriers take rate in response.

Related

-

January cat heatmap: California wildfires fuel rise in cat losses

February 21, 2025 -

Progressive pegs October vehicle losses from Milton, Helene at $206.5mn

November 15, 2024