Progressive

-

Insurance carriers tend to favor a negative outlook during their earnings calls, even when its unwarranted.

-

Despite numerous firms divesting their life operations in the past, companies are again nibbling at the edges.

-

Growth continued to slow as the company responds to adverse loss-cost trends.

-

Progressive races for rate, with Allstate slightly slower to account for a recent acquisition and restructuring.

-

The executive said Progressive was taking steps to address “persistent underperformance” in its property segment and emphasized the need to avoid concentrations of risk in areas with significant catastrophe exposure.

-

PIF growth is slowing as the firm sees worsening loss-cost trends, and this quick response will likely allow it to outperform peers again.

-

Trucking companies, having already increased self-insured retentions by millions, will need to contend with further rate increases into 2024.

-

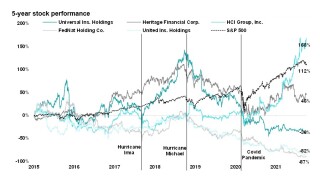

Inside P&C's Research team looks at the prospects of Florida's wave of new arrivals.

-

Remi Kent succeeds Jeff Charney who announced his retirement in March.

-

In a month impacted by hurricane losses, earnings showed slower growth and no improvement in underlying loss ratio.

-

Progressive expects $510mn of catastrophe losses associated with Hurricane Ida, the company said on Friday.

-

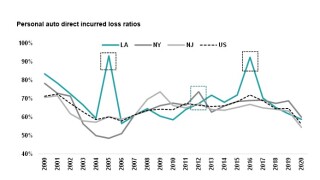

Ida soaks the tri-state – and has the potential to affect personal auto carriers more than comparable storms of the past.

Related

-

January cat heatmap: California wildfires fuel rise in cat losses

February 21, 2025 -

Progressive pegs October vehicle losses from Milton, Helene at $206.5mn

November 15, 2024