Progressive

-

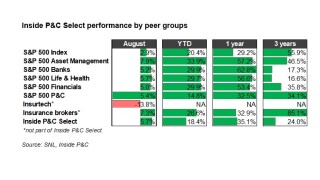

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

With predicted $20bn in losses, KBW doesn’t see meaningful change to the rate increase trajectory.

-

Texas’s objection to Progressive’s recent rate filings garnered attention, calling rates “excessive” and suggesting rebates instead.

-

The newcomers are finding it more difficult to disrupt the sector than they had expected.

-

The company faces elevated losses as it balances rate increases vs. growth.

-

Attorney television advertising targeting remote workers could have lasting impacts on personal auto trends.

-

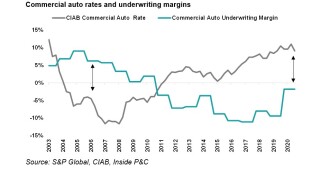

While the pandemic offered some relief to commercial auto insurers, maintaining margins will be tricky to achieve given rate moderation.

-

Progressive’s June results point to worsening underlying trends for personal auto carriers.

-

It may take a few more months for personal auto carriers to see the full extent of the impact.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

The personal lines giant's results are showing a reversion to pre-pandemic trends.

-

Progressive’s combined ratio for the month deteriorates by 60 basis points.

Related

-

January cat heatmap: California wildfires fuel rise in cat losses

February 21, 2025 -

Progressive pegs October vehicle losses from Milton, Helene at $206.5mn

November 15, 2024