Progressive

-

The carrier booked unfavorable prior accident year reserve development of 3.4 points, driven primarily by its personal auto products related to recently passed legislation in Florida.

-

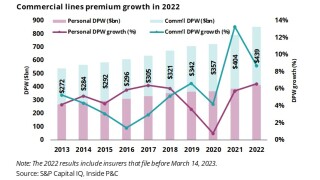

The new 2022 stat data shows personal lines premium has grown year-over-year, but the loss ratios have been hit hard by catastrophes and loss cost inflation.

-

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

The carrier also booked unfavorable prior accident year reserve development of 3.5 points.

-

2022 statutory data is now available, and results show winners and losers

-

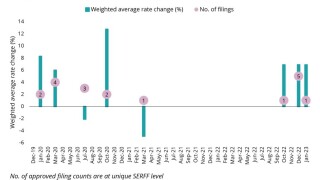

Rate action for personal auto insurers has been increasing in 2023 to balance rising loss cost trends

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Management spoke with analysts after the carrier released its 10-K and the CEO’s shareholder letter.

-

The carrier raised rates on average of 19% across the segment in 2022, with larger increases in Florida and hail-prone states such as Colorado and Oklahoma.

-

The carrier also booked unfavorable prior accident year reserve development of 6.5 points, driven primarily by its personal auto products.

-

The firm’s playbook struggles provide valuable insights for its InsurTech competitors as they all navigate a challenging loss cost environment.

-

Five auto insurers receive approval to raise rates after 32-month halt by the California Department of Insurance.

Related

-

January cat heatmap: California wildfires fuel rise in cat losses

February 21, 2025 -

Progressive pegs October vehicle losses from Milton, Helene at $206.5mn

November 15, 2024