Progressive

-

The company's net cat loss ratio increased to 18% from 8.3% in November, attributed primarily to winter storms, wind and thunderstorms.

-

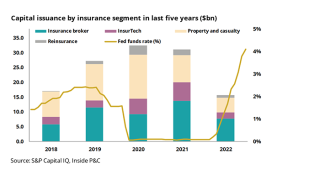

Increased interest rates and unfavorable market conditions led to reduction in capital issuance activity in the P&C insurance industry in 2022.

-

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

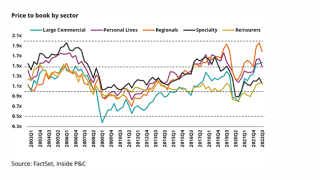

Personal lines insurers see a vastly different outlook in 2022 than 2021 and their reserve development reflects this.

-

The updated loss and allocated loss adjustment expenses in the property segment from the hurricane is now $1bn.

-

The insurer’s underlying loss ratio fell almost two points sequentially to 75.5% in November.

-

While Allstate may be beyond the worst of the reserve charges, execution of initiatives needs to go smoothly for it to get back on track.

-

The Canadian investment fund now owns almost 3.8 million shares of the personal lines insurer, compared to 281,773 in Q2.

-

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Progressive’s superior digital distribution and widening auto margins put it far ahead of the competition.

Related

-

January cat heatmap: California wildfires fuel rise in cat losses

February 21, 2025 -

Progressive pegs October vehicle losses from Milton, Helene at $206.5mn

November 15, 2024