-

Reinsurers, commercial and specialty carriers stocks edge down after Hurricane Ida, in line with dip in S&P Insurance Index.

-

Pressure on the InsurTechs – specifically Root and Lemonade – is intensifying.

-

The classic car insurer is expected to trade under the ticker HGTY.

-

The recent SPAC listings of Hippo and Doma have been subject to significant outfluxes of capital.

-

The venture capital firm is seeking a sustainable portfolio rather than firms ‘looking toward the next funding round’.

-

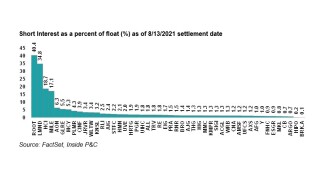

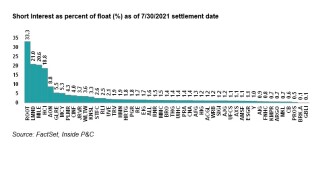

InsurTech short interest dwarfs legacy insurers as they come under pressure to produce profits.

-

The business acts as a transformer, allowing traditional asset managers the chance to participate on collateralised (re)insurance transactions.

-

InsurTech stocks fall in Thursday trading following Lemonade Q2 results.

-

The wholesale broker’s shares were up by about 8% on the day in the early afternoon, changing hands at $27.81 a share.

-

A vote on July 29 is expected to be less nerve-racking than once predicted, with investor appetite warming on the prospect of InsurTech SPAC mergers.

-

As part of expansion plans, Kin has also signed a stock purchase agreement to acquire an inactive insurance carrier that holds licenses in more than 40 states.

-

Progressive fell 3.2%, after the company indicated in its June earnings update that net income per share had dropped 56% in Q2.