-

CEO Greenberg said the insurer is achieving an adequate risk adjusted return in most of its portfolio, and that means that rate is adequate.

-

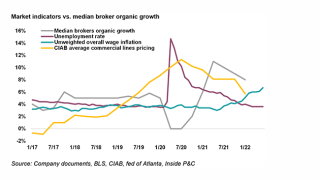

While brokers continue to report positive earnings, the possibility of a downturn shouldn’t be discounted.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer also completed the reorganization plan to consolidate its four Florida domiciled insurance carriers into two.

-

The Bermudian’s gross premiums written rose 9% year-on-year as increases from the insurance segment offset a 4% decrease in reinsurance.

-

The improvement was driven by a 0.4-point dip in the loss ratio YoY and a 1.1-point decrease in the expense ratio YoY.

-

The carrier said increased demand should maintain upward rate pressure at January 1.

-

In a Q2 earnings call, J Powell Brown described the impact on the broker if issues in Florida “were to all go to hell in a handbasket”.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The broker’s second-quarter adjusted diluted earnings per share rose by 6.3% to $0.51 per share, above analysts' average expectation of $0.48 per share.

-

The company’s property segment booked a combined ratio of 57.6%, 13.8 points higher compared to Q2 2021 due to a higher attritional loss ratio.

-

Inside P&C’s news team runs you through the key highlights of the week.