-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

WR Berkley founder and chairman Bill Berkley said that his company can add at least “several hundred million dollars” to its investment income, as the Federal Reserve hikes interest rates to tame inflation.

-

The specialty insurer reported growth across almost all lines of business as it shifted focus from rate to expansion.

-

The specialty carrier said hurricane season will have to play out before any market easing takes place, especially in the Southeast.

-

For domestic automobile, renewal premium change was 6.3%, up a full three points from the first quarter of 2022 and the carrier expects the increases to continue.

-

The CEO said Marsh McLennan had grown EPS through previous recessions and that tailwinds remained for the business.

-

The uptick runs counter to recent commentary on a slow drift down in rates.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

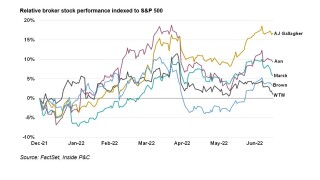

The broker’s results are being watched closely for signs of how the sector will fare in the current economic landscape.

-

The bank-owned broker reported positive earnings despite economic conditions, but results may vary for other brokers.

-

The company also said it expects a $408mn reserve charge, including $275mn related to personal auto and $91mn recorded for commercial auto.

-

GWP growth slowed to about 17% on the year, versus the 22% increase in Q1 2022.