-

Adjusted Ebitda margins narrowed by 200bps, as an uptick in T&E costs took its toll.

-

As we wrap up the first half of 2022, quarterly earnings will depend on how well firms react to economic challenges.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

For the quarter, Progressive posted a combined ratio of 95.6%, a slight improvement from 96.5% in Q2 2021.

-

The executive discussed InsurTech challenges, his priorities for Branch, fundraising, and his concerns about the capital markets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Results for May show that the carrier’s combined ratio rose above its 96% target after dipping in April.

-

he broker’s analysis found rate increases and lower cat experience contributed to strong underwriting results.

-

The firm posted a combined ratio of 81.3% for its P&C segment and 91.7% for its specialty unit, improving from 97.7% and 94.8% in Q1 2021, respectively.

-

The Bermudian’s Q1 LR decreased 17.2 points to 32.8% in the first quarter, offsetting a 1.4-point deterioration in the expense ratio to 19.6%.

-

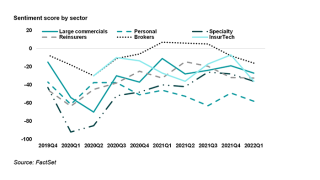

Sentiment scores are down across the industry, indicating pessimism regarding inflation and the economy.