-

Progressive booked a $621.2mn adverse development, compared with a $190.8mn reserve charge in Q1 2022.

-

Returns from April 1 and May 1 were at or exceeded the return levels of January 1 renewals.

-

Though strong growth continues, the future is less clear as driving forces potentially run out of steam.

-

Most of the losses were sustained by the reinsurance segment, which reported $108mn in pre-tax cat losses, compared with $110mn in the prior year period.

-

The firm reported flat reserve developments from its specialty and commercial P&C units in Q1, while a year ago the specialty segment posted a $10mn release.

-

The events were widespread, but each was under $100mn in size.

-

The company posted a 1.2-point increase in its loss ratio to 58.6%, as the firm saw less-favorable reserve releases and slightly higher cat losses during the quarter.

-

The company achieved renewal written price increases of 10% in the first quarter and expects increases to accelerate into the high teens later this year.

-

The carrier’s combined ratio totaled 100%, up 2.1 points from Q1 2022, reflecting a higher net loss ratio, partially offset by a lower net expense ratio.

-

The broker also said it grew in fac, as well as in its strategy and technology group.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

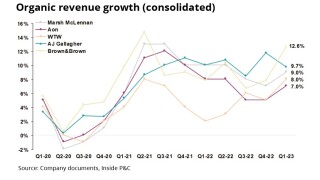

Aon’s results continue a trend of accelerated organic growth among brokers in the first quarter.