-

Carriers also reported premium expansion and improved solvency during the quarter.

-

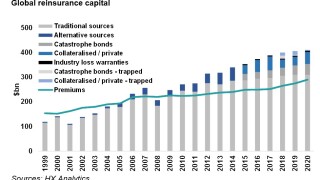

The changing reinsurance market dynamics are impacting reinsurers' ability to raise rates.

-

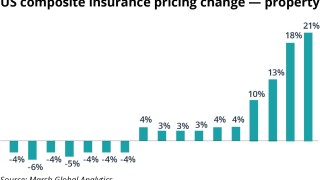

Property catastrophe accounts with poor loss history are facing rate increases of 20% more, versus 5%-10% rises for non-cat exposed business.

-

The level of price increases was lower than the 10% rise reported in the fourth quarter of 2020.

-

With the property casualty industry flush with capital, continuing to hold the line on rate rises will likely be challenging.

-

The intermediary also warned that inflation headwinds could affect the future cost of claims.

-

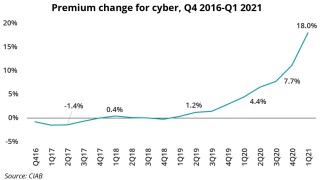

A surge of ransomware and other cyberattacks is driving premiums higher as losses increase, part of a broader trend of hardening across US commercial P&C lines.

-

Rate increases for all-sized accounts and across all lines of business slowed to 10% in the first quarter, down from 10.7% in Q4, according to recent survey data from the Council of Insurance Agents and Brokers (CIAB).

-

Competition is intensifying, with increased London market appetite one of the drivers.

-

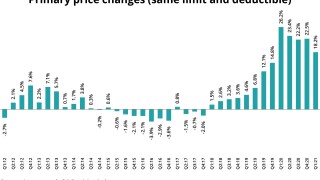

Primary D&O policies renewing with the same policy limit received average rate hikes of 18.2%, compared with 26.2% in Q1 2020.

-

The broker says rates remain low despite a surge in dealmaking towards the end of last year.

-

Rate increases in the niche market segment remained in the double digits, but the pace of gains was slower than in prior periods.