-

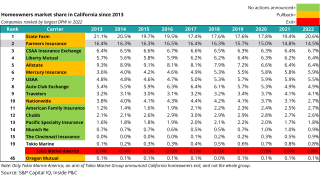

Lawmakers were discussing legislation that would have facilitated insurance commissioner Ricardo Lara’s ability to implement more insurer-friendly regulations, but talks stalled with just one week left in the 2023 legislative session

-

The independent brokerage, founded in 2019, will now be able to sell reinsurance risks from across Latin America directly to London underwriters.

-

Meanwhile, the FTC’s proposal has been delayed until April 2024 to give the agency time to consider all concerns about the rule because it faced strong opposition.

-

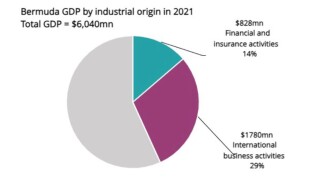

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

Board members voted five to four in favor of rate increases but fell short of the two-thirds majority required.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

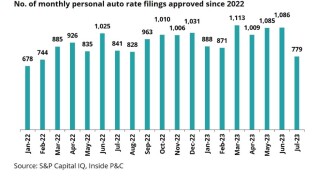

At the same time, insurers are assessing the level needed to address loss cost trends.

-

The agency said it will take rating actions where warranted.

-

The letter also called out California insurance companies for investing more than $536bn in the fossil-fuel industry in 2019 alone.

-

Farmers Insurance becomes the latest major national carrier to pump the brakes in California, limiting new business to only 7,000 policies per month, signaling further problems in the state’s homeowners’ market.

-

Inside P&C’s news team runs you through the key highlights of the week.